£0.00

September 28, 2021

Comments Off on Mr. Goxx Outperforms the S&P 500

What would be your reaction if told a Hamster is investing in digital currencies. And this is likely to occur from June and is now doing well than S&P 500?

“Intention Wheel”

Hamsters are now investing in several digital currencies and related assets. They started doing so  after getting knowledge of video games. We introduce to you Mr. Goxx, one of the world’s first digital currency investment Hamster. Goxx loves spending time in a unique office within an apartment. Here, he runs numerous investments that generate great rewards for him in return. The Hamster’s caretaker constructed the token name Goxx Box. It is a digital currency office linked with a giant living space. It’s from this cage that you find an “intention wheel.” It is necessary for running selections of virtual currencies. The wheel in his cage is such that Goxx can run it. After that, he made selections from dozens of virtual currencies. His excellent choice enables him to land into profitable investments.

after getting knowledge of video games. We introduce to you Mr. Goxx, one of the world’s first digital currency investment Hamster. Goxx loves spending time in a unique office within an apartment. Here, he runs numerous investments that generate great rewards for him in return. The Hamster’s caretaker constructed the token name Goxx Box. It is a digital currency office linked with a giant living space. It’s from this cage that you find an “intention wheel.” It is necessary for running selections of virtual currencies. The wheel in his cage is such that Goxx can run it. After that, he made selections from dozens of virtual currencies. His excellent choice enables him to land into profitable investments.

after getting knowledge of video games. We introduce to you Mr. Goxx, one of the world’s first digital currency investment Hamster. Goxx loves spending time in a unique office within an apartment. Here, he runs numerous investments that generate great rewards for him in return. The Hamster’s caretaker constructed the token name Goxx Box. It is a digital currency office linked with a giant living space. It’s from this cage that you find an “intention wheel.” It is necessary for running selections of virtual currencies. The wheel in his cage is such that Goxx can run it. After that, he made selections from dozens of virtual currencies. His excellent choice enables him to land into profitable investments.

after getting knowledge of video games. We introduce to you Mr. Goxx, one of the world’s first digital currency investment Hamster. Goxx loves spending time in a unique office within an apartment. Here, he runs numerous investments that generate great rewards for him in return. The Hamster’s caretaker constructed the token name Goxx Box. It is a digital currency office linked with a giant living space. It’s from this cage that you find an “intention wheel.” It is necessary for running selections of virtual currencies. The wheel in his cage is such that Goxx can run it. After that, he made selections from dozens of virtual currencies. His excellent choice enables him to land into profitable investments.On the other hand, both tunnels allow him to purchase or trade off the digital coin chosen by the wheel. The Hamster can get in his office to carry out several exercises. They then implement distinct digital currency ventures.

The Real Money

It’s through the intention wheel that enables Mr. Goxx to connect to the Arduino Nano. It requires the use of some encoding techniques. In the purchase and trade-off of the tunnel, there is a minute node that ‘smells’ whether Hamster is present or not. After detection, the node goes ahead to power on the LED lights. It is especially when a trade execution is about to happen. Arduino Nano is also responsible for enhancing communication with a customized Java application. The Java program can overlay details on the video feed. Since the video feed is usually live, investments are in real-time. You can see the live video updates from his Twitter account. This happens particularly after the completion of an investment day. Indeed, his choice is generally accompanied by actual monies, which he takes pride in.

Better than Bitcoin and S&P 500

We aren’t trying to drag you to such hamsters’ money decisions in one way or another. Goxx procedures aren’t scientific. The agency behind Hamster’s applications and financial assets is not yet known. For now, we can sharpen you with his portfolio; that’s almost 20 % from the time he kicked off. Mr. Goxx started his investments in June. By September 12th, Goxx was doing well than BTC and other digital assets like S&P 500.

aren’t trying to drag you to such hamsters’ money decisions in one way or another. Goxx procedures aren’t scientific. The agency behind Hamster’s applications and financial assets is not yet known. For now, we can sharpen you with his portfolio; that’s almost 20 % from the time he kicked off. Mr. Goxx started his investments in June. By September 12th, Goxx was doing well than BTC and other digital assets like S&P 500.

aren’t trying to drag you to such hamsters’ money decisions in one way or another. Goxx procedures aren’t scientific. The agency behind Hamster’s applications and financial assets is not yet known. For now, we can sharpen you with his portfolio; that’s almost 20 % from the time he kicked off. Mr. Goxx started his investments in June. By September 12th, Goxx was doing well than BTC and other digital assets like S&P 500.

aren’t trying to drag you to such hamsters’ money decisions in one way or another. Goxx procedures aren’t scientific. The agency behind Hamster’s applications and financial assets is not yet known. For now, we can sharpen you with his portfolio; that’s almost 20 % from the time he kicked off. Mr. Goxx started his investments in June. By September 12th, Goxx was doing well than BTC and other digital assets like S&P 500.This tells us that Important financial nuggets trigger Goxx processes. Some individuals have fetched financial advice from many platforms. This includes provides like Tiktok as well as ‘two kids’ from Baltimore. Still, you may find other sites offering prompt support on doubled trades within a short time. Recently, the crypto space has seen impacts by more stock picks on Wall Street.

September 27, 2021

Comments Off on Houbi to Stop Servicing Chinese Users

Not every country welcomes the idea of crypto business. China has been on the front line in matters of curbing down cryptocurrencies. As a result, crypto exchanges are striking back with ‘revenge’. Why is Houbi cutting relationships with China?

Cryptocurrencies are Illegal

Recently, we have seen the Chinese government putting strict measures on crypto. They are doing so to control the crypto business in the country. Individuals and crypto exchanges are losing hope,  therefore, discarding the digital currency developments. It’s a spike on the toe! Huobi is the world’s biggest digital currency exchange. They recently announced it would be dropping down Chinese users. There will be no creation of new accounts by Chinese citizens on Huobi’s platform. This came forth after Beijing made renewals on digital currency crackdown. The People’s Bank of China said that every cryptocurrency-related business is illegitimate. They further said that there’s no accommodation on the land. This includes all trades experienced on Friday. Central banks have no control over cryptocurrencies. So, the People’s Bank of China went to another level of declaring crypto business as illegal. The giant aims at overseas exchange platforms that offer crypto services in China.

therefore, discarding the digital currency developments. It’s a spike on the toe! Huobi is the world’s biggest digital currency exchange. They recently announced it would be dropping down Chinese users. There will be no creation of new accounts by Chinese citizens on Huobi’s platform. This came forth after Beijing made renewals on digital currency crackdown. The People’s Bank of China said that every cryptocurrency-related business is illegitimate. They further said that there’s no accommodation on the land. This includes all trades experienced on Friday. Central banks have no control over cryptocurrencies. So, the People’s Bank of China went to another level of declaring crypto business as illegal. The giant aims at overseas exchange platforms that offer crypto services in China.

therefore, discarding the digital currency developments. It’s a spike on the toe! Huobi is the world’s biggest digital currency exchange. They recently announced it would be dropping down Chinese users. There will be no creation of new accounts by Chinese citizens on Huobi’s platform. This came forth after Beijing made renewals on digital currency crackdown. The People’s Bank of China said that every cryptocurrency-related business is illegitimate. They further said that there’s no accommodation on the land. This includes all trades experienced on Friday. Central banks have no control over cryptocurrencies. So, the People’s Bank of China went to another level of declaring crypto business as illegal. The giant aims at overseas exchange platforms that offer crypto services in China.

therefore, discarding the digital currency developments. It’s a spike on the toe! Huobi is the world’s biggest digital currency exchange. They recently announced it would be dropping down Chinese users. There will be no creation of new accounts by Chinese citizens on Huobi’s platform. This came forth after Beijing made renewals on digital currency crackdown. The People’s Bank of China said that every cryptocurrency-related business is illegitimate. They further said that there’s no accommodation on the land. This includes all trades experienced on Friday. Central banks have no control over cryptocurrencies. So, the People’s Bank of China went to another level of declaring crypto business as illegal. The giant aims at overseas exchange platforms that offer crypto services in China.Binance Blocks Chinese Phone Numbers

Huobi released a statement related to this. It has declined new account creation by Chinese citizens. The firm will also scrap already enrolled Chinese individuals by the end of this year. Moving away from the Houbi company, we have Binance. It is another company that has blocked Chinese mobile numbers.

Additionally,  Binance has also disabled the download capabilities. This prevents using the application in Chinese land. It is a company that follows compliance with seriousness. Doing so shows faithfulness to the local authority’s requirements. Particularly when it comes to its operations.

Binance has also disabled the download capabilities. This prevents using the application in Chinese land. It is a company that follows compliance with seriousness. Doing so shows faithfulness to the local authority’s requirements. Particularly when it comes to its operations.

Binance has also disabled the download capabilities. This prevents using the application in Chinese land. It is a company that follows compliance with seriousness. Doing so shows faithfulness to the local authority’s requirements. Particularly when it comes to its operations.

Binance has also disabled the download capabilities. This prevents using the application in Chinese land. It is a company that follows compliance with seriousness. Doing so shows faithfulness to the local authority’s requirements. Particularly when it comes to its operations.This year alone, the Chinese government has gone ahead to intensify crackdowns. This trend is not new in China and doesn’t seem to stop soon. This is because financial regulators in China consistently worry about virtual coins. And they want to curb the effects of it on economic stability.

Taking Controls

Du Jun, Huobi’s co-founder, started his reply. He said they began taking control after seeing the notice from the central bank. The senior official didn’t mention the approximate number of users that would suffer. The company was embarking on a world expansion program. They are doing so for substantial growth across continents. Token-Pocket, a prominent service provider of digital coin wallets, added similar comments. There is an effect on users from an abrupt termination of services. This is so specific to the mainland Chinese users risking violating set up policies.

John Wu, head of Ava Labs, also gave his views concerning the released notice. He doesn’t believe that the move would set a standardized framework. So other nations regulate crypto activities as per their law. A few years ago, Chinese crackdown procedures appeared. This caused outflows in the capital. This affects many exchange platforms. This caused at least $28.1B to flow from digital currency exchanges like OKEx.

September 25, 2021

Comments Off on What is Sharding, and why is it hard to put in place?

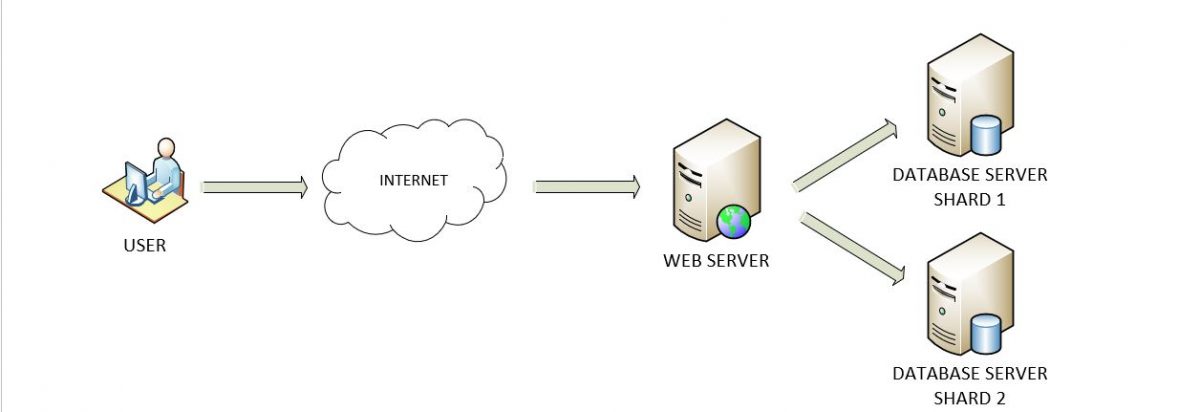

It is challenging for blockchain platforms to execute sharding. Since it’s more complicated and hard to use. In the traditional database setup, it is the method of scaling huger databases.

Scalability Issues and Complexity

Scaling helps in making queries, therefore, minding about the access techniques. On top of the above definition, massive databases are horizontally divided. This involves many mini databases that  don’t share details. As a result, its querying and scaling are now simplified. Therefore, no need for the addition of extra information.

don’t share details. As a result, its querying and scaling are now simplified. Therefore, no need for the addition of extra information.

don’t share details. As a result, its querying and scaling are now simplified. Therefore, no need for the addition of extra information.

don’t share details. As a result, its querying and scaling are now simplified. Therefore, no need for the addition of extra information.The time needed to make queries correlates with the database size. The outcome is scalability issues since it leads to complexity in database queries. Data has a division over many databases. After which, the sorting concerning the size of the database. In such a case, the discrete database begins to grow. Again, the infrastructure required for the maintenance becomes a bit complex.

Databases Passed Through Sharding

One core database requires enormous amounts of power. The exact costs do apply to make sure duplication of data present in the system occurs. Such aspects team up to establish a scaling challenge in the database setup.

Sharding has the aim of correcting such problems. This is through the division of data and the infrastructure costs. If the size shrinks, minimal processing and duplication techniques help in increasing efficiency. Databases passed through sharding becomes simple to start queries. This is due to their smaller sizes. Furthermore, the supply of such databases is cheaper hosting services. Scaling may be limitless when there is an appropriate execution of sharding policies.

Do Blockchains Need Sharding Implementation?

It’s simple to execute sharding through setups of more accessible rules. Here, the major party manages every  shard. Therefore, you can get correct details linked with data-position. But, in the blockchain, the major party cannot track data present on the blockchain. The outcome is – many problems, especially with data used in sharding.

shard. Therefore, you can get correct details linked with data-position. But, in the blockchain, the major party cannot track data present on the blockchain. The outcome is – many problems, especially with data used in sharding.

shard. Therefore, you can get correct details linked with data-position. But, in the blockchain, the major party cannot track data present on the blockchain. The outcome is – many problems, especially with data used in sharding.

shard. Therefore, you can get correct details linked with data-position. But, in the blockchain, the major party cannot track data present on the blockchain. The outcome is – many problems, especially with data used in sharding.A good example is Ethereum which is second to Bitcoin. It’s a used blockchain in the world today. The use is for distributed apps and tokens. Scalability problems afflict ether because of its transaction throughput. It has a capping of between 15 and 20 transactions every second. This cap is not adequate to maintain the blockchain’s power of functionality. The PoW (Proof-of-Work) procedure is the main decider. It decides the order of every transaction to avoid network problems. Each computer in the network should carry available copies of the blockchain. Apart from this, they should also have synchronized transactions.

Like the traditional databases, computers on the chain are usually placed in subsets. Sharding after that takes place according to the sorting procedures. Exponential scaling of nodes happens since every shard processes parallel transactions. This is better compared to the synchronization process of such transactions.

September 24, 2021

Comments Off on Chainlink Accepts Alchemy Pay to Enhance Investment on Decentralized Exchanges (DEX)

What are Alchemy Pay and Chainlink?

Alchemy Pay users can now celebrate this brilliant news. This is after the platform-enabled crypto purchase from the decentralized exchange platforms. Now, users can get loan packages from  the decentralized finance top site. They will get them right into their digital wallets. It has been possible by Alchemy Pay token ERC20, ACH. Alchemy recently enrolled with Chainlink. Crypto and related firms use it to add high-quality market data to their smart contracts.

the decentralized finance top site. They will get them right into their digital wallets. It has been possible by Alchemy Pay token ERC20, ACH. Alchemy recently enrolled with Chainlink. Crypto and related firms use it to add high-quality market data to their smart contracts.

the decentralized finance top site. They will get them right into their digital wallets. It has been possible by Alchemy Pay token ERC20, ACH. Alchemy recently enrolled with Chainlink. Crypto and related firms use it to add high-quality market data to their smart contracts.

the decentralized finance top site. They will get them right into their digital wallets. It has been possible by Alchemy Pay token ERC20, ACH. Alchemy recently enrolled with Chainlink. Crypto and related firms use it to add high-quality market data to their smart contracts.Alchemy Pay invented the first advanced fiat and virtual currency payment solution. The design is for enterprises and traders. With Alchemy, you can adopt blockchain technology, therefore, creating access to crypto investments. Digital currency investments and Defi goodies are available in the fiat ecosystem.

Chainlink’s Accuracy Through Robust Technology

On the other hand, we have Chainlink. A platform that helps every user get fair rates. It is useful when buying virtual assets using digital wallets. The purchase is usually through decentralized exchanges (DEX). It includes platforms such as Sushiswap, ACH, and Uniswap. The CEO of Alchemy Pay, John Tan, said that the payment gateway framework is essential. It plays a part in their success. Particularly when it comes to the ACH value. ACH has a distribution throughout the economic system. Tangible technology enables Chainlink and, it has embraced clarity. It is robust tech that protects the platform from downtime and external manipulations.

On-chain Referencing

Also, it’s good to know that asset pricing isn’t a data feed on the blockchain (off-chain). However, an answer is to take it from the chain and later present it on-chain for referencing. The on-chain referencing happens  when users initiate transactions that involve various digital currencies. It’s vital when the pricing of assets reflects the volume weight averages. It’s fetched from all investment environments. This is more crucial compared to a single exchange. It is because you can achieve the prevention of inaccuracy.

when users initiate transactions that involve various digital currencies. It’s vital when the pricing of assets reflects the volume weight averages. It’s fetched from all investment environments. This is more crucial compared to a single exchange. It is because you can achieve the prevention of inaccuracy.

when users initiate transactions that involve various digital currencies. It’s vital when the pricing of assets reflects the volume weight averages. It’s fetched from all investment environments. This is more crucial compared to a single exchange. It is because you can achieve the prevention of inaccuracy.

when users initiate transactions that involve various digital currencies. It’s vital when the pricing of assets reflects the volume weight averages. It’s fetched from all investment environments. This is more crucial compared to a single exchange. It is because you can achieve the prevention of inaccuracy.Alchemy integrated with Chainlink in 2020. It gave birth to an excellent platform. Chainlink has thus become a significant element in Alchemy’s daily business. It has links for most of the cases. Thanks to their gateway system of payment. Every retailer has pledged ACH on the network system for practical usage. ACH collateralization must enable users to use Alchemy’s payment system. This will complete the acceptance of digital currencies physically and on online depots. From this, Alchemy can convert the trader’s required fiat currencies. Payment transactions get completed within seconds. This is approximately 30 % of the total cost of the legacy payment system.

Over 2 Million Hubs Globally

Alchemy Pay’s main sites link to traders. This includes platforms such as Binance and the e-commerce platform Shopify. This is a remarkable representation of at least 2M hubs globally. The Chainlink platform helped in securing value amounting to over 10 billion. This cuts across both Centralized and Decentralized Finances.

September 16, 2021

Comments Off on Slavi Kutchoukov Introduces his Digital Coin, Slavi Coin

Slavi Kutchoukov is a tycoon behind the introduction of Slavi Coin. It’s a digital innovation that has led to a token distribution of 1 billion SLV. The coin’s value remains unpredictable up to date.

Internet with Innovations

Internet introduction in the world today has led to numerous developments. Among these developments is the introduction of digital coins. It’s clear that digital coins are set to win over traditional money.  The reason is that governments cannot control it. For digital coins, governments nor central banks have control over it. That’s the reason why most people are going the crypto way. This has allowed them to achieve financial privacy and escape audits. Firms have started adopting the internet. And this allows them to offer clients swift and simplified services.

The reason is that governments cannot control it. For digital coins, governments nor central banks have control over it. That’s the reason why most people are going the crypto way. This has allowed them to achieve financial privacy and escape audits. Firms have started adopting the internet. And this allows them to offer clients swift and simplified services.

The reason is that governments cannot control it. For digital coins, governments nor central banks have control over it. That’s the reason why most people are going the crypto way. This has allowed them to achieve financial privacy and escape audits. Firms have started adopting the internet. And this allows them to offer clients swift and simplified services.

The reason is that governments cannot control it. For digital coins, governments nor central banks have control over it. That’s the reason why most people are going the crypto way. This has allowed them to achieve financial privacy and escape audits. Firms have started adopting the internet. And this allows them to offer clients swift and simplified services.Tycoons like Slavi Kutchoukov, look into such advances within the crypto space. He went ahead to accept the challenge of coming up with their own digital tokens. Most of these tycoons have a common thing. They ensure that digital coins are able to adapt. So that it can adapt to the wants of consumers within the business jurisdiction. Due to this, yearlong businesses like real estate are going for cryptocurrency innovations. because it can help them meet the needs arising in the marketplace.

Slavi Kutchoukov is Promising Various Novelties

The tycoon is prominent especially when it comes to real estate businesses. He is also popular in the fashion industry in regions like the United Kingdom and UAE. Slavi Kutchoukov has prestigious motors, money as well as spiced women around him. We can simply conclude – he has it all except digital coins identified with him. To ensure he has it all, Slavi Kutchoukov is after fulfilling the goal. He now owns at least a single virtual coin named after him. The tycoon is now jovial to introduce SLV.

industry in regions like the United Kingdom and UAE. Slavi Kutchoukov has prestigious motors, money as well as spiced women around him. We can simply conclude – he has it all except digital coins identified with him. To ensure he has it all, Slavi Kutchoukov is after fulfilling the goal. He now owns at least a single virtual coin named after him. The tycoon is now jovial to introduce SLV.

industry in regions like the United Kingdom and UAE. Slavi Kutchoukov has prestigious motors, money as well as spiced women around him. We can simply conclude – he has it all except digital coins identified with him. To ensure he has it all, Slavi Kutchoukov is after fulfilling the goal. He now owns at least a single virtual coin named after him. The tycoon is now jovial to introduce SLV.

industry in regions like the United Kingdom and UAE. Slavi Kutchoukov has prestigious motors, money as well as spiced women around him. We can simply conclude – he has it all except digital coins identified with him. To ensure he has it all, Slavi Kutchoukov is after fulfilling the goal. He now owns at least a single virtual coin named after him. The tycoon is now jovial to introduce SLV.Slavi Kutchoukov clarified that the token will guide the digital currency market. Such views are highly motivated by the nice reception SLV coin has had since its formation. The virtual currency has promised various novelties in the crypto market. These novelties include swift financial transactions, safety. It also has simple ways of using the newly introduced coin. With such benefits, people have an opportunity to use the coin regardless of where they are.

1 Billion Token Supply

There are zero records of the first token value. But it comes with a total distribution of 1 Billion worth of SLV in space. The supply is open to the public for purchase. The Slavi Kutchoukov coin is likely to launch in a few weeks to come. Thereafter it will get activated within premises under the tycoon’s management.

The crypto space continues to grow daily. SLV isn’t the only digital money in the crypto world today. We also have Solana which has made a historical step today. In 2020, Solana got introduced to the market. Its value has continued to gain momentum over the past few months.

September 12, 2021

Comments Off on All You Need to Know About Decentralized Autonomous Organization (DAO)

When a person decides to organize with other people on ways to introduce their own policies. Then Decentralized Autonomous Organization (DAO) is the best way to make this happen. DAO also contributes to the decision-making processes attached to blockchain technology.

What’s DAO?

In several definitions, you will find DAO as an entity represented by policies. It is also put as transparent computer software. It’s normally under the control of members belonging to that organization.  The central government has no influence at all to manipulate the organization. Policies or rules are usually attached to a code that requires no management. Things like bureaucracy or hierarchy frameworks have no room in such organizations.

The central government has no influence at all to manipulate the organization. Policies or rules are usually attached to a code that requires no management. Things like bureaucracy or hierarchy frameworks have no room in such organizations.

The central government has no influence at all to manipulate the organization. Policies or rules are usually attached to a code that requires no management. Things like bureaucracy or hierarchy frameworks have no room in such organizations.

The central government has no influence at all to manipulate the organization. Policies or rules are usually attached to a code that requires no management. Things like bureaucracy or hierarchy frameworks have no room in such organizations.Nowadays, we have extreme usage of the internet around the globe. Users and the upcoming generation are the upcoming social entities. They are eagerly seeking solutions to many social problems. Does it also include methods of exchanging values in an environment equipped with trustworthiness? Blockchain technology has the capacity to enable trusted automated transactions. This also includes trustworthiness in such things as value exchanges. Internet users worldwide desire to put things in order. They want to achieve security and effectiveness. This is essential especially when working with same-minded individuals.

Bitcoin Fully Functional with DAO

Bitcoin (BTC) is the first in the crypto space. It fully functioned with the Decentralized Autonomous Organization and has computed rule setups. The system works in an autonomous way and it’s driven via consensus and related protocols. Not every Decentralized Autonomous Organization has taken space by force like BTC. Looking back in the month of May 2016, a German entity, slock. It introduced an innovation dubbed ‘The DAO’. This was to boost their version in the decentralized market. During that time, their story was a success which came with crowdfunding evangelism. It even collected at least 150M dollars of ETH (Ethereum). It’s so unfortunate that the code employed in their DAO had several flaws. Due to their hesitation, Cybercriminals managed to steal 50M dollars of Ether. This caused issues, especially with slock.it consumers who lost trust with the system as well as ETH.

Decentralized Finance Improves DAO

Today,  we have an outbreak of Defi (Decentralized Finance) that came into much effect in the year 2020. Defi has really helped to increase refreshed interests in Decentralized Autonomous organizations. Because now you have a good ideology of what DAO is, it’s essential to glean how the system works.

we have an outbreak of Defi (Decentralized Finance) that came into much effect in the year 2020. Defi has really helped to increase refreshed interests in Decentralized Autonomous organizations. Because now you have a good ideology of what DAO is, it’s essential to glean how the system works.

we have an outbreak of Defi (Decentralized Finance) that came into much effect in the year 2020. Defi has really helped to increase refreshed interests in Decentralized Autonomous organizations. Because now you have a good ideology of what DAO is, it’s essential to glean how the system works.

we have an outbreak of Defi (Decentralized Finance) that came into much effect in the year 2020. Defi has really helped to increase refreshed interests in Decentralized Autonomous organizations. Because now you have a good ideology of what DAO is, it’s essential to glean how the system works.How does it work?

The key thing in Decentralized Autonomous organizations is a smart contract. Smart contracts normally define entity rules and also keeps the group’s finances. By the time a smart contract gets activated on Ether, there cannot be any manipulations to the rules. There is only one exception that is to start a voting process. So, for individuals who do something against the programmed rules, failure occurs. The treasury regulates expenditures to ensure no one uses finances inappropriately. Whereas the authorization of payments is through group votes.

September 10, 2021

Comments Off on Close to $50B Scrapped off the Price of the ASX

Very recently, one of the Australian markets has collapsed drastically. It was the anxious behavior of traders about the widespread destruction of Covid-19. The pandemic is a threat to drag the world economy behind, making the recovery process more rigid.

Fall in ASX 200

The stock exchange almost lost 1 % in the previous trade. Therefore, causing at least a two percent  drop in the market. Industries closed with some huge minuses. The banks, as well as oil stocks, weighed down the marketplace. There was a fall in ASX 200. It was a 1.9% fall which is 147 scores towards 7.37K. Only six stocks made returns, while four were stable. Other 190 stocks fell beyond the 200 index mark.

drop in the market. Industries closed with some huge minuses. The banks, as well as oil stocks, weighed down the marketplace. There was a fall in ASX 200. It was a 1.9% fall which is 147 scores towards 7.37K. Only six stocks made returns, while four were stable. Other 190 stocks fell beyond the 200 index mark.

drop in the market. Industries closed with some huge minuses. The banks, as well as oil stocks, weighed down the marketplace. There was a fall in ASX 200. It was a 1.9% fall which is 147 scores towards 7.37K. Only six stocks made returns, while four were stable. Other 190 stocks fell beyond the 200 index mark.

drop in the market. Industries closed with some huge minuses. The banks, as well as oil stocks, weighed down the marketplace. There was a fall in ASX 200. It was a 1.9% fall which is 147 scores towards 7.37K. Only six stocks made returns, while four were stable. Other 190 stocks fell beyond the 200 index mark.A Drop Within a Day

According to Commsec on Twitter, this was a massive drop with 24 hours. There was a comparison to the previous one in February 2021 and the minimum closure in July. A senior officer at Burman Invest commented on losses incurred on AOI. The amounts totaled about 48B dollars. Julia Lee, a senior investment officer, said markets were closing to record highs. The massive issue of concern is that Delta is consuming the economy and affecting growth. Iron ore pricing dropped at least four percent in one night to around 130 dollars per tonne. This change in pricing made massive miners weigh on the marketplace after the drop.

Other components affected include Rio Tinto, which shed at least 2.5% while BHP dropped by 1.7%. Still, Fortescue Metals were also involved. They recorded a 0.6% fall. According to Julia Lee, all these changes in value are a result of miners carrying lots of damage.

Good Business Moving Forward

There  has been a felt reduction for deferred payments by borrowers. This is a report that came from the NAB (National Australian Bank). The decline is due to the current situation in the economic system. Ross McEwan went ahead to talk with the legislative committee. He told them about billions of loans that got deferred. It was a 1.8B dollar figure compared with fifty-eight billion dollars at the peak of the Coronavirus in 2020. According to Mc Ewan, there is a belief that a good investment before the pandemic is suitable.

has been a felt reduction for deferred payments by borrowers. This is a report that came from the NAB (National Australian Bank). The decline is due to the current situation in the economic system. Ross McEwan went ahead to talk with the legislative committee. He told them about billions of loans that got deferred. It was a 1.8B dollar figure compared with fifty-eight billion dollars at the peak of the Coronavirus in 2020. According to Mc Ewan, there is a belief that a good investment before the pandemic is suitable.

has been a felt reduction for deferred payments by borrowers. This is a report that came from the NAB (National Australian Bank). The decline is due to the current situation in the economic system. Ross McEwan went ahead to talk with the legislative committee. He told them about billions of loans that got deferred. It was a 1.8B dollar figure compared with fifty-eight billion dollars at the peak of the Coronavirus in 2020. According to Mc Ewan, there is a belief that a good investment before the pandemic is suitable.

has been a felt reduction for deferred payments by borrowers. This is a report that came from the NAB (National Australian Bank). The decline is due to the current situation in the economic system. Ross McEwan went ahead to talk with the legislative committee. He told them about billions of loans that got deferred. It was a 1.8B dollar figure compared with fifty-eight billion dollars at the peak of the Coronavirus in 2020. According to Mc Ewan, there is a belief that a good investment before the pandemic is suitable.Additionally, Ewan continued to say that many consumers are already in economic difficulties. That has further increased. This was as a result of the Delta variant that broke in the region.

Currently, most business ventures are hibernating. Such businesses are anticipating policies to pop up to get on track once more. In fact, for established and small businesses in existence, the situation is a bit complex. Mr. Ewan added that Australia is a country that requires a vaccine pass like nations in Europe. Currently, about 80% of qualified citizens in Australia have received their vaccinations. They had their initial vaccine jab in 3 weeks. That means their 2nd vaccine jab would happen by November 15th.

September 1, 2021

Comments Off on Pump-and-dump ‘manipulation’ affects cryptocurrency markets

The pump and dump games have lured the attention of digital enthusiasts. They even attract financial regulation teams altogether. At the same time, the digital currency space is becoming a healthy ground. But this is also very special for criminal business.

Anatomy in Crypto Transactions

Cryptocurrency comprises hacking activities as well as “get rich quick” schemes. There  are many rampant and more activated over some period of time now. The pump and dump players in the crypto space may be organizers. They can also be participants or even exchange platforms. We have distinct people-organized teams responsible for pump-and-dump programs coordination. These groups and individuals later become the main beneficiaries of the entire scheme.

are many rampant and more activated over some period of time now. The pump and dump players in the crypto space may be organizers. They can also be participants or even exchange platforms. We have distinct people-organized teams responsible for pump-and-dump programs coordination. These groups and individuals later become the main beneficiaries of the entire scheme.

are many rampant and more activated over some period of time now. The pump and dump players in the crypto space may be organizers. They can also be participants or even exchange platforms. We have distinct people-organized teams responsible for pump-and-dump programs coordination. These groups and individuals later become the main beneficiaries of the entire scheme.

are many rampant and more activated over some period of time now. The pump and dump players in the crypto space may be organizers. They can also be participants or even exchange platforms. We have distinct people-organized teams responsible for pump-and-dump programs coordination. These groups and individuals later become the main beneficiaries of the entire scheme.Participants in the digital currency world have also plagued the crypto markets. These are investors who purchase given coins. This act is after getting instructions from the pump and dump organizers. They get the information on the type of coin to purchase. This, therefore, results in fixing the price of digital currency for pumping. Most people end up purchasing virtual coins with inflation aspect. They also end up becoming victims of the pump-and-dump ‘manipulation’.

Exchange platforms may be triggers of a crypto market ailment. In most cases, pump groups select a target platform for pump-and-dump business. Other times, you may note that some exchanges have a link to pump and dump activities. One of the reasons why most crypto groups opt for this is because of high transaction charges. An exchange can earn high transaction fees for an increase in trade volumes. These volumes are in most cases triggered by the pump-and-dump schemes.

Attraction to Scams

These pump-and-dump activities can birth a 65% increase in the crypto world in a couple of minutes. All they need is 7 minutes for a given coin to touch its peak level. This is with a trading volume of nearly thirteen  times the normal day volumes. Most investors get lured to crypto scams bearing in mind that most of them are at a zero-sum level. Here, wealth redistribution normally occurs between the organized teams and manipulators. Activities like gambling normally peak especially when anxiety and loneliness strikes. This is the reason behind such gaming activities becoming prominent today.

times the normal day volumes. Most investors get lured to crypto scams bearing in mind that most of them are at a zero-sum level. Here, wealth redistribution normally occurs between the organized teams and manipulators. Activities like gambling normally peak especially when anxiety and loneliness strikes. This is the reason behind such gaming activities becoming prominent today.

times the normal day volumes. Most investors get lured to crypto scams bearing in mind that most of them are at a zero-sum level. Here, wealth redistribution normally occurs between the organized teams and manipulators. Activities like gambling normally peak especially when anxiety and loneliness strikes. This is the reason behind such gaming activities becoming prominent today.

times the normal day volumes. Most investors get lured to crypto scams bearing in mind that most of them are at a zero-sum level. Here, wealth redistribution normally occurs between the organized teams and manipulators. Activities like gambling normally peak especially when anxiety and loneliness strikes. This is the reason behind such gaming activities becoming prominent today.These are patterns or manipulations unlike what is usually noticed with traditional marketplaces. There are no tricks, manipulation itself has come out clearly in the limelight. Manipulators can purchase up to 24 million dollars worth of digital currency. This is for pump and dump schemes. As a result, there is a collection of profits with an estimation of 6 million dollars, from each pump. Volume differences get reconciled especially before and after a pump signal.

The Bottom Line

Recently, we noticed many actors in the pump and dump activities. They are facing weighty criminal offenses and penalties. This explosion in the realms put financial regulators in a stiff environment. Some are under the hot seat for failing to take crypto matters seriously.

August 31, 2021

Comments Off on Bug Impacting Ether Network Leads to Fork

Bugs ailing the older version of the Ether network. It even caused several computers to split from the major network. As revealed in a report from Ether foundation, it’s said that consensus bugs struck Ether some hours ago.

The Older Version

This exploited the consensus bugs rectified in Geth version 1.10.8. According to Martin Sweden, a security agent from Ether foundation. Many people are already notified. In addition to his  comments, Martin said that this impact is a close shave. The close shave is really affecting at least fifty percent of Ether consumers. The mentioned bug affected version 1.10.1 as well as the previous models of Geth users.

comments, Martin said that this impact is a close shave. The close shave is really affecting at least fifty percent of Ether consumers. The mentioned bug affected version 1.10.1 as well as the previous models of Geth users.

comments, Martin said that this impact is a close shave. The close shave is really affecting at least fifty percent of Ether consumers. The mentioned bug affected version 1.10.1 as well as the previous models of Geth users.

comments, Martin said that this impact is a close shave. The close shave is really affecting at least fifty percent of Ether consumers. The mentioned bug affected version 1.10.1 as well as the previous models of Geth users.Another expert, Marius Wijden, also gave his own report. He stated on the Twitter platform that someone may have discovered the bug. He also said that there was a rectification in the previous version. He added that the person went ahead to exploit the bug rectified in @go_ethereum. Therefore, causing a network hitch. So, clients already using version 1.10.7 needs to perform an update of their versions. This update is mandatory in order to mitigate future harm.

The Big Concern

According to a press release, there was an audit to unearth the origin of the bug. Later on, they discovered a bug hidden in Telos- Ethereum Virtual Machine (EVM). The machine was present in the blockchain.  According to auditors, the bug was an extreme matter that needed swift action. Specialists got a notification of this plight and by August 24th. A unique patch helped to rectify the problem. After announcing this, the team said that there will be an attack vector provided. The attack will offer users enough time to carry out an update on their computers. These were in relation to the node applications.

According to auditors, the bug was an extreme matter that needed swift action. Specialists got a notification of this plight and by August 24th. A unique patch helped to rectify the problem. After announcing this, the team said that there will be an attack vector provided. The attack will offer users enough time to carry out an update on their computers. These were in relation to the node applications.

According to auditors, the bug was an extreme matter that needed swift action. Specialists got a notification of this plight and by August 24th. A unique patch helped to rectify the problem. After announcing this, the team said that there will be an attack vector provided. The attack will offer users enough time to carry out an update on their computers. These were in relation to the node applications.

According to auditors, the bug was an extreme matter that needed swift action. Specialists got a notification of this plight and by August 24th. A unique patch helped to rectify the problem. After announcing this, the team said that there will be an attack vector provided. The attack will offer users enough time to carry out an update on their computers. These were in relation to the node applications.At least 70 % of Geth clients are using the previous version that seems to have issues. This means nearly 54% of Ether computers are using the main system bug. The major concern remains that clients may be risking Cyber-attacks. Especially where there is a use of digital currency and transactions are overwritten. Research from Block Research has discovered the main address that used the bug. A consumer financed the address using Tornado cash. This bug has the capacity to affect several chains like the BSC (Binance Smart Chain).

The Fork Impacts

Yes, a segment of computers has separated from the main network. Still, it does not seem to have a big impact yet but in the near future, this may be a different story altogether. It seems that most people in the mining field are now using the ‘new’ version of Ether. This means that hashing rate supports the longest chains. Computers already using the old version of Geth don’t have the capacity to gain access to the major network. Swift action helped to mitigate the possible effects making the network stable.

August 28, 2021

Comments Off on What is an IEO (Initial Exchange Offering)?

You may have come across the term IEO that’s well known in the crypto space. But wait, did you get its meaning? Were you able to understand the whole IEO concept? Let’s help you know IEO from A to Z and thank us later.

Initial Exchange Offerings is popularly known by its abbreviation, IEO. It is popular in raising funds  via an investment site which is simply a fund drive event. Here digital currency newbies come together to contribute money. This is slightly different from the ICO. Here the firms try to earn from interests from their projects posted on their websites. In the year 2017, the Chinese government hunted down the Initial Coin Offerings. It even caused a lot of scrambles in the crypto space. Crypto businesses had to find other ways of sustaining their new business projects.

via an investment site which is simply a fund drive event. Here digital currency newbies come together to contribute money. This is slightly different from the ICO. Here the firms try to earn from interests from their projects posted on their websites. In the year 2017, the Chinese government hunted down the Initial Coin Offerings. It even caused a lot of scrambles in the crypto space. Crypto businesses had to find other ways of sustaining their new business projects.

via an investment site which is simply a fund drive event. Here digital currency newbies come together to contribute money. This is slightly different from the ICO. Here the firms try to earn from interests from their projects posted on their websites. In the year 2017, the Chinese government hunted down the Initial Coin Offerings. It even caused a lot of scrambles in the crypto space. Crypto businesses had to find other ways of sustaining their new business projects.

via an investment site which is simply a fund drive event. Here digital currency newbies come together to contribute money. This is slightly different from the ICO. Here the firms try to earn from interests from their projects posted on their websites. In the year 2017, the Chinese government hunted down the Initial Coin Offerings. It even caused a lot of scrambles in the crypto space. Crypto businesses had to find other ways of sustaining their new business projects.The Rising Popularity

The Initial Exchange Offerings typically take place on virtual exchanges. The courtesy for this is to firms introducing brand new tokens. Newbies have to commit themselves to pay up fee charges. Plus, several proportions of sold tokens. This happens to raise funds on a given exchange platform. Tokens are later put on the listing on the exchange platform. After completing the Initial Exchange Offering. This dramatically helps to empower and display the firm’s profile. Moreover, this is critical in front of prospective investors. But, ICO’s contributions are usually transferred to smart contracts. This includes the likes of BSC (Binance Smart Contract). Everyone who takes part sends the contribution via the site that houses the IEO. The IEO has proved to become popular among many digital currency exchange platforms.

Binance Launchpad and IEO

The Binance Launchpad isn’t new when it comes to Initial Exchange Offerings. Among other platforms, it has  managed to stand out significantly. So, despite the stiff competition in the crypto space, it continues to grow. One of the hugest reasons for its existence is the felt integrity and trust. Token sales carried out by exchanges have possibilities of criminal activities taking place. But with IEO, illegal activities, as well as other related scams, become minimal. This is in comparison to Initial Coin Offerings, which may not be the case. Firms with a high level of reputation can perform their due diligence. Moreover, this becomes evident for projects offered to clients.

managed to stand out significantly. So, despite the stiff competition in the crypto space, it continues to grow. One of the hugest reasons for its existence is the felt integrity and trust. Token sales carried out by exchanges have possibilities of criminal activities taking place. But with IEO, illegal activities, as well as other related scams, become minimal. This is in comparison to Initial Coin Offerings, which may not be the case. Firms with a high level of reputation can perform their due diligence. Moreover, this becomes evident for projects offered to clients.

managed to stand out significantly. So, despite the stiff competition in the crypto space, it continues to grow. One of the hugest reasons for its existence is the felt integrity and trust. Token sales carried out by exchanges have possibilities of criminal activities taking place. But with IEO, illegal activities, as well as other related scams, become minimal. This is in comparison to Initial Coin Offerings, which may not be the case. Firms with a high level of reputation can perform their due diligence. Moreover, this becomes evident for projects offered to clients.

managed to stand out significantly. So, despite the stiff competition in the crypto space, it continues to grow. One of the hugest reasons for its existence is the felt integrity and trust. Token sales carried out by exchanges have possibilities of criminal activities taking place. But with IEO, illegal activities, as well as other related scams, become minimal. This is in comparison to Initial Coin Offerings, which may not be the case. Firms with a high level of reputation can perform their due diligence. Moreover, this becomes evident for projects offered to clients.Maximized Security and Visibility

The KYC and the AML (Anti Money Laundering) are some of the fundamental mechanisms. These are in place by exchange platforms to regulate. The KYC looks into verifying the identities of individuals who connect to the platform. However, this is not a likely situation for token issuers. Instead, such firms tend to acquire help, especially when doing business marketing. At some point, the Initial Exchange Offerings have gained credibility. When compared to the Initial Coin Offerings, it is. The IEO involves higher costs for newbies in return for security and max visibility.