£0.00

April 7, 2021

Comments Off on Grayscale Looking to Convert GBTC Into a Bitcoin ETF

The $34 billion trust Grayscale publicly said that it has plans to convert itself into an ETF. They are looking to get this done if the regulators are ready to give them a get-go. This could prove to be a beneficial move for the firm. As it allows them to create an advantage in cryptocurrency investing. Because as time passes other companies are planning to do something similar.

People who want to invest in Bitcoin through the stock market indirectly. Grayscale Trust is one of the only few options that are available. Because regulators in the US haven’t approved any Bitcoin ETFs yet.

Is Greyscale Affected by this Decision?

Some time ago, a lot of discounts were available on the Grayscale shares. This indicates to us that  many investors have sold their current positions. It is very likely due to the coming approval of Bitcoin ETFs.

many investors have sold their current positions. It is very likely due to the coming approval of Bitcoin ETFs.

many investors have sold their current positions. It is very likely due to the coming approval of Bitcoin ETFs.

many investors have sold their current positions. It is very likely due to the coming approval of Bitcoin ETFs.These new funds are going to charge much lesser. If you compare it to Grayscale’s management fee, which stands at 2%. Not only this, even the price of a lot of other actively managed funds cannot compete with this.

Compared to a Bitcoin ETF, the Grayscale Trust has plenty of other shortcomings. New investors who are purchasing new shares need six months of waiting time. Buyers cannot even trade the stocks in the secondary market during this interim.

What makes ETFs unique?

There is nothing of this sort in ETFs. Therefore, it is helpful for those investors who want to track the performance of this digital currency. They can do so without the hindrance of any outside factors. However, this makes it prone to the ETF Arbitrage strategy. As the fund price discrepancy of Bitcoin can be very large at times.

This results in an immediate arbitraging away of assets. Where underlying assets generate a price gap. And the market makers redeem the differences between prices.

Is there any other Bitcoin ETF coming soon?

In any case, Grayscale is not going to be the sole player in the game for very long. The access to the US-listed  Bitcoin ETF in the form of security will be going to multiple investors. This will include people who are waiting for a very long period. It would not only allow institutional investors. But individuals and financial advisors will also have easy access to digital assets.

Bitcoin ETF in the form of security will be going to multiple investors. This will include people who are waiting for a very long period. It would not only allow institutional investors. But individuals and financial advisors will also have easy access to digital assets.

Bitcoin ETF in the form of security will be going to multiple investors. This will include people who are waiting for a very long period. It would not only allow institutional investors. But individuals and financial advisors will also have easy access to digital assets.

Bitcoin ETF in the form of security will be going to multiple investors. This will include people who are waiting for a very long period. It would not only allow institutional investors. But individuals and financial advisors will also have easy access to digital assets.In early February, the approval of the first Bitcoin ETFs took place. Many more requests followed that in the coming weeks. How can we forget about the BTCC? After just two months of trading, Purpose Bitcoin ETF(BTCC) was able to do wonders. It accumulated a staggering $1.2 billion through management assets.

But this doesn’t make it easy to invest. As it is already hard for a daily investor to maintain their trading account. It becomes even hard to manage coins that they bought and are now a part of their portfolio.

April 5, 2021

Comments Off on BitXmi offers users monetary benefits for Trading on their Platform

There are many well-known crypto exchanges available in the market. Due to heavy competition, each of these exchanges offers unique offers and rewards. This attracts new customers. But have you ever heard of an exchange that pays you to trade? Probably not! BitXmi is one such unique crypto exchange that is pulling this off in style. It recently launched an impressive campaign specifically for April.

To encourage their users, BitXmi is offering them a BXMI token in return as a reward. This might be the first time any user could earn a free token as a trading return. The value of BXMi token increased by 7 times since August 2020; it stands around $0.70. This platform attracts users from all across the globe with this lucrative offer.

To encourage their users, BitXmi is offering them a BXMI token in return as a reward. This might be the first time any user could earn a free token as a trading return. The value of BXMi token increased by 7 times since August 2020; it stands around $0.70. This platform attracts users from all across the globe with this lucrative offer.Guidelines to earn this Reward:

- The first and foremost requirement is that the trade volume must be more than $50.

- This campaign is date bound; you will be able to reap these rewards from 5th April to 30th April.

- You can also earn 35% of a referred sign-up done on BitXmi via your code.

- Traders will be earning 0.05% on the volume of trade they make. They will receive BXMI tokens worth the equivalent amount.

More Info about the Campaign:

Although BitXmi has a global footprint. Most of its users are from India, Middle East, UAE & Europe. This offer is mainly targeted to their regular users. A trader that makes a substantial number of crypto trades in April will get bonus tokens. That’s not all. Users that make a trade of more than $50 will also pay zero fees. The exchange will bear all their costs and also pay the extra money for trading.

The

CEO of BitXmi, Sanjay Jain, also said that this token’s value would increase rapidly. He mentions that the company predicts BXMI to be around $ 1.00 by the end of 2021. The main reason for this can be its rapid increase in value since its inception in 2020.

What are BXMI Tokens?

BXMI tokens are BitXmi exchange-backed tokens. The initial trade for this token happened in July 2020. You can directly exchange them against USDT. The users can use it to pay off trading fees, earn dividends, or use it for investments. The exchange is working very hard to make this token acceptable in UAE.

The release of an ERC-20 token provides extra leverage to traders. It is also used for making the platform more agile and also as a reward token. The exchange aims to use this token as a driving force of their loyalty programs.

BitXmi is a Singapore-based exchange service provider found in 2018. It operates on a uniquely modern approach. This makes it different from other cryptocurrency exchanges.

April 3, 2021

Comments Off on Here’s All You Need to Know About NFT

Technology has now made us socio-friendly. We share lots of memes, infographics, artwork, and other digital property. Mostly with our friends and family. It can be either for entertainment or information. Also, it can be to spread awareness on a specific agenda.

However, did it come to your mind? Who’s the creator of these properties? Or where is the actual origin of those digital assets? The solution is NFT.

What is NFT?

An NFT or Non-fungible tokens is, in essence, a collectible digital property. The value is held as cryptocurrency. NFTs are value-conserving investments, similar to art, which is a visual form. But how?

So, NFT stands for a non-fungible token. This is a digital token that’s identical to cryptocurrency.  It has similar properties to Bitcoin or Ethereum. But unlike Bitcoin, it is not exchangeable. An NFT is specific and is not exchangeable like-for-like (hence, non-fungible).

It has similar properties to Bitcoin or Ethereum. But unlike Bitcoin, it is not exchangeable. An NFT is specific and is not exchangeable like-for-like (hence, non-fungible).

It has similar properties to Bitcoin or Ethereum. But unlike Bitcoin, it is not exchangeable. An NFT is specific and is not exchangeable like-for-like (hence, non-fungible).

It has similar properties to Bitcoin or Ethereum. But unlike Bitcoin, it is not exchangeable. An NFT is specific and is not exchangeable like-for-like (hence, non-fungible).Why NFTs are so crucial?

NFTs have become highly popular with crypto customers and companies alike. The reason is that NFTs brought in a revolution to the gaming space. Around $174 million is now spent on NFTs from November 2017.

Thanks to the arrival of blockchain technology. Gamers are now perpetual proprietors. It can be an in-game item and different specific property and make money from them. Players create and monetize objects like casinos and subject parks in digital worlds. This includes things like a Sandbox and Decentraland. Also, there’s the possibility of selling items that are accrued through gameplay. It can be in the form of costumes, or in-game currency.

How Did NFT Suddenly Become so Popular

Several industries use NFTs based on ERC-721. Below are some excellent features that make NFTs popular:

- The entire data of NFT is secure in Blockchain. This means the tokens are not removable. No matter what, you cannot destroy or duplicate it.

- The primary source of cost for NFTs is their scarcity. However, NFT developers can make an endless number of tokens. They’re saved limited purposefully to keep their value.

- NFTs are indivisible. Therefore, unlike Bitcoins NFTs are not available in denominations.

NFTs Characteristics

1. Non-Interoperable

NFTs are considered non-interoperable due to their ERC 721 base. This means that the data saved in them  are unexchangeable or utilized in any manner.

are unexchangeable or utilized in any manner.

are unexchangeable or utilized in any manner.

are unexchangeable or utilized in any manner.2. Rare

NFTs are scarce. Needless to say, this contributes to both the craze and price of NFTs. Therefore, if the quantity goes down from here due to any reason, the prices will shoot way higher.

3. Indestructible

People control NFTs through Blockchain, which provides them with more safety. This also makes them indestructible and un-removable at any cost.

4. Indivisible

You cannot send NFT partially to anyone (unlike different cryptocurrencies). It is because they’re non-fungible and don’t have a described value. For example, one bitcoin will own the same price after the transfer, but an NFT won’t.

April 1, 2021

Comments Off on Form 1099B on its way to becoming the “Gold Standard”

Owning crypto assets is becoming more and more popular these days. But the government knows it is challenging to regulate the happenings in this market. They are constantly thinking about multiple ways to make it viable for scrutiny. Even after numerous attempts to bind the traders. The government is coming with a very new approach which is also used in barter exchanges. The Internal Revenue Service is working nonstop to make crypto gains taxable to its core. They are looking for multiple methods to regulate taxability and stop evasion.

They are now making the exchanges responsible for maintaining records of their traders. Once the implementation of form 1099-B is complete. The IRS is looking to dish out records of profits and  losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.What is Form 1099-B?

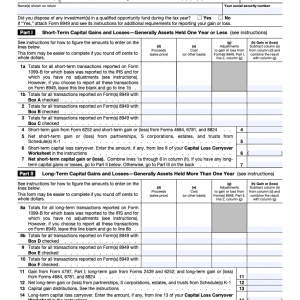

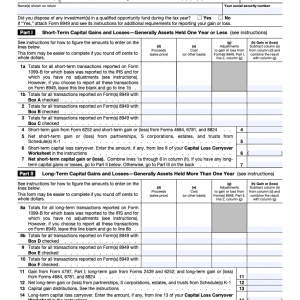

The form 1099-B primarily records proceeds from broker & barter exchanges. It is mainly used for recording profits and losses of one financial year. The taxpayer has nothing to fill out, as the platform provides them with all the details. With this new rule, crypto exchanges will have to provide the traders with a filled-out form. Which they will transfer to their individual form 8949. The primary purpose of using 8949 is to calculate total profits and losses. After which, the final information goes to Schedule D under their tax return.

Why is it difficult for Exchanges to maintain this?

Crypto assets such as BTC ease the transfer of holdings. As the occurrence is in abundance quantity. It is hard for exchanges to maintain all the records on a trader’s behalf. The reason is the absence of accurate data with cost centers. This is very is essential for filling 1099-B.

What’s more, they have to do it for every user and every trade that occurs on their exchange.

Who can file 1099-B?

Form  1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer. Let’s say you deal in stocks, and you sold many shared in your previous financial years. Let’s say the total amount was around $15K. In this case, this amount will reflect in the IRS from two different sources. Here, the broker will report this under his 1099-B, and you will report it under your capital gains.

You can easily add the form 1099-B to your tax returns by going to the Federal section’s official website. Under which you have to record it in the Schedule-D section.