£0.00

April 1, 2021

Comments Off on Form 1099B on its way to becoming the “Gold Standard”

Owning crypto assets is becoming more and more popular these days. But the government knows it is challenging to regulate the happenings in this market. They are constantly thinking about multiple ways to make it viable for scrutiny. Even after numerous attempts to bind the traders. The government is coming with a very new approach which is also used in barter exchanges. The Internal Revenue Service is working nonstop to make crypto gains taxable to its core. They are looking for multiple methods to regulate taxability and stop evasion.

They are now making the exchanges responsible for maintaining records of their traders. Once the implementation of form 1099-B is complete. The IRS is looking to dish out records of profits and  losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.

losses. This might emerge as the best possible way to report crypto transactions for IRS. But it has become a severe headache for the exchanges.What is Form 1099-B?

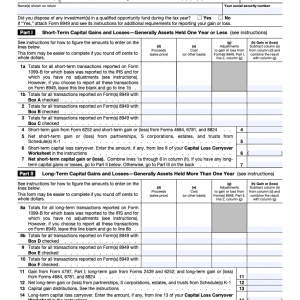

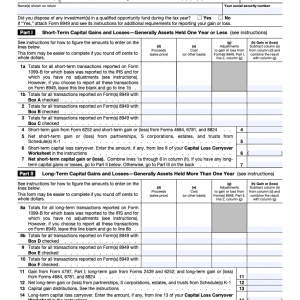

The form 1099-B primarily records proceeds from broker & barter exchanges. It is mainly used for recording profits and losses of one financial year. The taxpayer has nothing to fill out, as the platform provides them with all the details. With this new rule, crypto exchanges will have to provide the traders with a filled-out form. Which they will transfer to their individual form 8949. The primary purpose of using 8949 is to calculate total profits and losses. After which, the final information goes to Schedule D under their tax return.

Why is it difficult for Exchanges to maintain this?

Crypto assets such as BTC ease the transfer of holdings. As the occurrence is in abundance quantity. It is hard for exchanges to maintain all the records on a trader’s behalf. The reason is the absence of accurate data with cost centers. This is very is essential for filling 1099-B.

What’s more, they have to do it for every user and every trade that occurs on their exchange.

Who can file 1099-B?

Form  1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer.

1099-B is for recording profits and losses from multiple exchangeable commodities. It contains records of gains from stocks, options, securities, and other commodities. Here the broker had to submit this form to the IRS along with a copy to their customers. This includes people dealing in any commodity through their brokerage channel. This form also serves as a profit and loss statement for the taxpayer. Let’s say you deal in stocks, and you sold many shared in your previous financial years. Let’s say the total amount was around $15K. In this case, this amount will reflect in the IRS from two different sources. Here, the broker will report this under his 1099-B, and you will report it under your capital gains.

You can easily add the form 1099-B to your tax returns by going to the Federal section’s official website. Under which you have to record it in the Schedule-D section.