£0.00

July 20, 2021

Comments Off on Legislators and Accounting Agencies Lobbying for Solid Crypto Accounting Policies

There are expectations that executives will face difficulty when accounting for virtual assets. The problem is a result of the volatile investments. A factor most traders want to see reflecting in their financial reports due to the value attached to it.

Accountability for Cryptocurrencies

Accounting agents and legislators are now making an urge to standard setters. They want them to input a null and put down certain grounded rules. These will instruct firms on accountability  issues for cryptocurrencies including BTC, and Ethereum. These investments have non-binding American accounting standards. As a result, they have caused great attention to financial authorities. This came along due to the past weeks’ actual economic swings and trading by firms like Tesla and Square. In April, the BTC had risen to at least 63,380 dollars and has now sliced into two. This has mirrored the volatility levels of other virtual coins and assets. The SEC controls the mandate to oversee America’s security exchange. They have now begun considering the said regulations for cryptocurrencies and respective markets. There will be a significant change in the prevention of fraudulent acts in the ecosystem.

issues for cryptocurrencies including BTC, and Ethereum. These investments have non-binding American accounting standards. As a result, they have caused great attention to financial authorities. This came along due to the past weeks’ actual economic swings and trading by firms like Tesla and Square. In April, the BTC had risen to at least 63,380 dollars and has now sliced into two. This has mirrored the volatility levels of other virtual coins and assets. The SEC controls the mandate to oversee America’s security exchange. They have now begun considering the said regulations for cryptocurrencies and respective markets. There will be a significant change in the prevention of fraudulent acts in the ecosystem.

issues for cryptocurrencies including BTC, and Ethereum. These investments have non-binding American accounting standards. As a result, they have caused great attention to financial authorities. This came along due to the past weeks’ actual economic swings and trading by firms like Tesla and Square. In April, the BTC had risen to at least 63,380 dollars and has now sliced into two. This has mirrored the volatility levels of other virtual coins and assets. The SEC controls the mandate to oversee America’s security exchange. They have now begun considering the said regulations for cryptocurrencies and respective markets. There will be a significant change in the prevention of fraudulent acts in the ecosystem.

issues for cryptocurrencies including BTC, and Ethereum. These investments have non-binding American accounting standards. As a result, they have caused great attention to financial authorities. This came along due to the past weeks’ actual economic swings and trading by firms like Tesla and Square. In April, the BTC had risen to at least 63,380 dollars and has now sliced into two. This has mirrored the volatility levels of other virtual coins and assets. The SEC controls the mandate to oversee America’s security exchange. They have now begun considering the said regulations for cryptocurrencies and respective markets. There will be a significant change in the prevention of fraudulent acts in the ecosystem.Security Policies Looking Alike

Before, Gary Gensler brought an argument to rule out trader security policies. These are similar to derivatives and capital investment rules in the crypto industry. Another world body in the financial sector suggested a solution. They want financial institutions accepting digital assets to focus on holding large buffers. They say this will mitigate the possible economic downfalls.

FASB Seeks Public Views

Looking at financial accounting, there has been no recorded progress. The FASB involved itself in this matter.  It will be setting up the accounting standards for firms both at the public, private levels. It will also overlook the non-profit organizations in America. They decided not to add the discussion to its agenda. They cited that trading in digital currencies is not widely spread among firms. In the previous month, the board went ahead to launch a consultation statement. This is to seek views from the public about different priorities. The response from accounting boards and people considered newly suggested accounting assignments. This will look similar to financial reports on virtual assets. Again, the body looks forward to reviewing the feedback by 22nd Sept 2021.

It will be setting up the accounting standards for firms both at the public, private levels. It will also overlook the non-profit organizations in America. They decided not to add the discussion to its agenda. They cited that trading in digital currencies is not widely spread among firms. In the previous month, the board went ahead to launch a consultation statement. This is to seek views from the public about different priorities. The response from accounting boards and people considered newly suggested accounting assignments. This will look similar to financial reports on virtual assets. Again, the body looks forward to reviewing the feedback by 22nd Sept 2021.

It will be setting up the accounting standards for firms both at the public, private levels. It will also overlook the non-profit organizations in America. They decided not to add the discussion to its agenda. They cited that trading in digital currencies is not widely spread among firms. In the previous month, the board went ahead to launch a consultation statement. This is to seek views from the public about different priorities. The response from accounting boards and people considered newly suggested accounting assignments. This will look similar to financial reports on virtual assets. Again, the body looks forward to reviewing the feedback by 22nd Sept 2021.

It will be setting up the accounting standards for firms both at the public, private levels. It will also overlook the non-profit organizations in America. They decided not to add the discussion to its agenda. They cited that trading in digital currencies is not widely spread among firms. In the previous month, the board went ahead to launch a consultation statement. This is to seek views from the public about different priorities. The response from accounting boards and people considered newly suggested accounting assignments. This will look similar to financial reports on virtual assets. Again, the body looks forward to reviewing the feedback by 22nd Sept 2021.Conducting Reviews on Digital Assets

Under newly found rules, ventures have to conduct reviews of asset values every 12 months. Now, firms will have to put down values when there is a drop below the buying price. This will also depend on the outcomes of impairment tests. But, when values rise, firms can go ahead to record gains. This will be so after selling off their digital assets and not when these assets are on hold.

July 17, 2021

Comments Off on All About ASK

In the recent news brief, permission.io appointed a privacy tech law expert. A move to enhance data integrity and communication. Overall this is also for the expansion of partnering power as well as monetization of raw data.

Rachel’s Appointment is a Golden Opportunity

The company is a leader in permission-enabled adverts and a creator of a famous crypto coin.  Also called “ASK,” which empowers clients. The company recently appointed a marketing and communication director, Rachel Miller. She is a knowledgeable law expert. She also has decent background experience in private and compliance issues. It will be beneficial in the overall development of the consumer interface aspects. It will also ensure clarity and transparency in the communication system. The move will significantly enhance consumer interactions. This communication touches mostly on the utilization of clients’ data. Also, how to use that and its benefits from monetization. This is while navigating the client’s journey.

Also called “ASK,” which empowers clients. The company recently appointed a marketing and communication director, Rachel Miller. She is a knowledgeable law expert. She also has decent background experience in private and compliance issues. It will be beneficial in the overall development of the consumer interface aspects. It will also ensure clarity and transparency in the communication system. The move will significantly enhance consumer interactions. This communication touches mostly on the utilization of clients’ data. Also, how to use that and its benefits from monetization. This is while navigating the client’s journey.

Also called “ASK,” which empowers clients. The company recently appointed a marketing and communication director, Rachel Miller. She is a knowledgeable law expert. She also has decent background experience in private and compliance issues. It will be beneficial in the overall development of the consumer interface aspects. It will also ensure clarity and transparency in the communication system. The move will significantly enhance consumer interactions. This communication touches mostly on the utilization of clients’ data. Also, how to use that and its benefits from monetization. This is while navigating the client’s journey.

Also called “ASK,” which empowers clients. The company recently appointed a marketing and communication director, Rachel Miller. She is a knowledgeable law expert. She also has decent background experience in private and compliance issues. It will be beneficial in the overall development of the consumer interface aspects. It will also ensure clarity and transparency in the communication system. The move will significantly enhance consumer interactions. This communication touches mostly on the utilization of clients’ data. Also, how to use that and its benefits from monetization. This is while navigating the client’s journey.The Chief Executive Officer said something critical to Permission.io, Charlie Silver. He touched on the active adjustments in the privacy policies in the global realm. Furthermore, the company understands the advantages of complete integrity levels. And is aware of this evolving around their economic system. In truth, individual privacy is now turning to become the most prioritized agenda. An initiative considered to motivate and empower people to contribute to different relationships.

‘The New Wine’

Concerning matters of Tiktok, Rachel Miller emphasized inner activities and developments. She also identified, analyzed, and implemented areas that require some improvement. R. Silver took care of the private  escalations without forgetting about critical players. Such experience originating from a fast-growing world entity needs individuals like Rachel Miller. Such people can contribute energy, time, and resources to the development. Silver also touched on the digital coins and privacy landscape. This sounds the same for both changing and matters of law still exercising the catch-up game. Silver believes that matters touching on privacy are taking a certain angle. It is so when it comes to what we call consent-based frameworks.

escalations without forgetting about critical players. Such experience originating from a fast-growing world entity needs individuals like Rachel Miller. Such people can contribute energy, time, and resources to the development. Silver also touched on the digital coins and privacy landscape. This sounds the same for both changing and matters of law still exercising the catch-up game. Silver believes that matters touching on privacy are taking a certain angle. It is so when it comes to what we call consent-based frameworks.

escalations without forgetting about critical players. Such experience originating from a fast-growing world entity needs individuals like Rachel Miller. Such people can contribute energy, time, and resources to the development. Silver also touched on the digital coins and privacy landscape. This sounds the same for both changing and matters of law still exercising the catch-up game. Silver believes that matters touching on privacy are taking a certain angle. It is so when it comes to what we call consent-based frameworks.

escalations without forgetting about critical players. Such experience originating from a fast-growing world entity needs individuals like Rachel Miller. Such people can contribute energy, time, and resources to the development. Silver also touched on the digital coins and privacy landscape. This sounds the same for both changing and matters of law still exercising the catch-up game. Silver believes that matters touching on privacy are taking a certain angle. It is so when it comes to what we call consent-based frameworks. The permission entity can grasp and embody such aspects. Rachel will also unite a group that will focus on enhancing technological issues. And related revolutions evolving around it. She also promised to help the entire Permission.io fraternity. So that the company comes to the realization of value gained during matters about their data.

Benefits to Platform Consumers

Overall, the startup company has also been consistent in teaming up. They are working on the customer’s behalf. This is to achieve a fairer and clean internet power for a reasonable period. By doing so, businesses shall raise their margin levels. This aspect is achievable through the study of customer behavior. It will also involve research about their product and service tastes. R. Silver is the recent appointment in the startup company that’s having a fast-rising team.

July 16, 2021

Comments Off on Ethereum ETF Approved by Brazil’s Securities Regulator

Brazilian B3 stock will see financial investments. They will also use custodian services offered by an entity named Winklevoss.

Investment on B3

CVM is the Brazilian security authority that has authorized the ETH invested funds. A report  according to QR Capital revealed this information. The QR holds the company’s assets and manages them accordingly. This finance invests courtesy of QETH11 and shall see funds on the exchange (B3). B3 functions in the region and offers full support to clients in the global realm. The ticker (QETH11) shall highly utilize the Ethereum indexes. It uses the same way the CME team does and therefore shall exploit services offered by Wink.

according to QR Capital revealed this information. The QR holds the company’s assets and manages them accordingly. This finance invests courtesy of QETH11 and shall see funds on the exchange (B3). B3 functions in the region and offers full support to clients in the global realm. The ticker (QETH11) shall highly utilize the Ethereum indexes. It uses the same way the CME team does and therefore shall exploit services offered by Wink.

according to QR Capital revealed this information. The QR holds the company’s assets and manages them accordingly. This finance invests courtesy of QETH11 and shall see funds on the exchange (B3). B3 functions in the region and offers full support to clients in the global realm. The ticker (QETH11) shall highly utilize the Ethereum indexes. It uses the same way the CME team does and therefore shall exploit services offered by Wink.

according to QR Capital revealed this information. The QR holds the company’s assets and manages them accordingly. This finance invests courtesy of QETH11 and shall see funds on the exchange (B3). B3 functions in the region and offers full support to clients in the global realm. The ticker (QETH11) shall highly utilize the Ethereum indexes. It uses the same way the CME team does and therefore shall exploit services offered by Wink.The Brokerage System

The product pitching by the fund giver terms the package as secure and a regulated selection. According to that, it is perfect for traders to enhanced exposure to ETH. This will be via the brokerage system in which customers don’t have to worry about enrollments. This involves the stock exchange, digital pouches, or even the privatized keys. The Asset Management entity purchases the real Ether for the package and promises.

This will  ensure quality levels of integrity as well as safety for the ticker traders. This assurance was by the Chief Executive Officer to the Asset Management (QR Capital). He also adds that the Brazilian finance regulators are aware of the maturity of crypto coins. The benefits will be for traders eager to explore brand new categories. There is hope that the said signals from the Brazilian land will support and motivate SEC. This will be to authorize the ETF in the United States.

ensure quality levels of integrity as well as safety for the ticker traders. This assurance was by the Chief Executive Officer to the Asset Management (QR Capital). He also adds that the Brazilian finance regulators are aware of the maturity of crypto coins. The benefits will be for traders eager to explore brand new categories. There is hope that the said signals from the Brazilian land will support and motivate SEC. This will be to authorize the ETF in the United States.

ensure quality levels of integrity as well as safety for the ticker traders. This assurance was by the Chief Executive Officer to the Asset Management (QR Capital). He also adds that the Brazilian finance regulators are aware of the maturity of crypto coins. The benefits will be for traders eager to explore brand new categories. There is hope that the said signals from the Brazilian land will support and motivate SEC. This will be to authorize the ETF in the United States.

ensure quality levels of integrity as well as safety for the ticker traders. This assurance was by the Chief Executive Officer to the Asset Management (QR Capital). He also adds that the Brazilian finance regulators are aware of the maturity of crypto coins. The benefits will be for traders eager to explore brand new categories. There is hope that the said signals from the Brazilian land will support and motivate SEC. This will be to authorize the ETF in the United States. Reports from CVM followed with aspects related to the recent digital currencies. This also involved the ETF authorization done in March. This includes the 100 % BTC and other 5 digital currencies. The cryptos are also invested in the stocks. Similarly, the BTC-only package is under the management of the asset management entity. The investment commenced as powered by QBTC11 in June 2021.

Approval Delay in America

Besides the authorization of Ethereum by the security regulator. There was another close story of BTC ETF approval in the Canadian land. This happened in Feb when the security body in Canada offered a go-ahead. The approval served as a green signal for the initially realized BTC ETF. Furthermore, a similar incident occurred in the land of America. Here the security regulator is taking up digital ETF authorizations.

This happened after seeing a rise in demand in the regions. This came along after a postponement of a decision whether to authorize the funds or not. There were several statements concerning the newly proposed policy amendment. These are in relation to the funds and emphasized their importance. It also said that these were responsible for the overall delay of the approval. The regulator, in his defense, cited that statement. He says it was suitable to carry out a long-term designation to take necessary action towards the ETF.

July 7, 2021

Comments Off on Spain Initiates New Digital Euro Proposal

In the past few years, the financial sector has recorded a remarkable progression. This is due to the creation of virtual currencies. A prominent figure in this is the CBDCS. They are also known as the Central Bank Digital Currencies.

The ideology has caused several Central banks to take interest. European Central bank (ECB), and the Bank of Japan, have developed interests in crypto. The European Central bank went ahead to  make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.

make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.

make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.

make a publication citing many threats. In the write-up, they talked about the association of failure to embark on the financial plan. The Spanish Socialist Party was also involved. They injected a proposal to encourage creation. Here a team is responsible for research. They are meant to examine the virtual Euro. The overall study was to help discover ways in which the virtual Euro currency may function. The party launched a zero law proposal. Therefore, this will help record feedback on the reduced usage of the traditional currency.The Central Bank Digital Currencies

The CBDCS are the virtual crystal formats of current currencies. This includes Euro and the American dollar. These currencies may offer some real power to governments and centralized banks. Especially when it comes to causing stimuli to the overall economic system. Besides the ecosystem, the authority may extend to financial program execution. Such as the UBI (Universal Basic Income) as well as the possible collection of real-time taxes.

In theory, the Central Bank Digital Currencies grant the respective giant banks authority. With this, they will deliver  special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector.

special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector.

special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector.

special payments directly to the public. The same can help to send it to their virtual wallets. This is useful, especially when the economic depression strikes. In recent reports, the are grown speculations citing liquid cash injection. It gets created with virtual money. This has a certain expiration. Its utilization is when buying several items. A nice example is when you give close thought to payments linked to welfare programs. This system’s utilization is on basic items such as food, clothes, and shelter. As things unfold, the Central Bank Digital Currencies may cause a reduction. It will certainly cause a reduction in the roles of banks in the private financial sector. Privacy Freedom Concerns and Tracking

There is a great worry linked to private freedom and financial surveillance. This will act the moment the Central Bank Digital Currencies program kicks off. The governments may exercise greater power. This can make investors more uncomfortable when managing their digital assets. The capacity to give out virtual payments to the public comes with possibilities. Several individuals have gone ahead to question these decisions. They want to know whether the governments will make financial restrictions. And to whom will it be applicable among its population. This will also shed light on the direct implementation of tracking systems. As they are very useful to monitor the economic patterns of the public at large.

July 6, 2021

Comments Off on Why to worry about crypto frauds?

The financial threats have been evolving around attractive labels and pop-ups. Such as ‘get richer quick,’ ‘become a financial guru in easy steps’ among other spiced formats. This has been loud. Especially on social media platforms and via direct emails. There were bold and highlighted headings. You were to make moves and make huger investments. That too in an unrealistic time frame.

Scammers on the Next Level

Besides the trial currencies, scammers have gone to the next level. They have also started duping active and prospective investors in the crypto world. Various digital currencies like Bitcoin,  Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk.

Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk.

Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk.

Ethereum, Dogecoin, and Litecoin have also afflicted. That’s why several financial regulators are coming in. Which is to restrict some investments in the crypto space. A report came out recently. It showed an incredible explosion in the digital world of cryptos. This is causing scamming groups to come out pretending to be multi-billionaires. Due to these investments. Some have gone beyond pretending to be Tesla or Elon Musk. According to Pinsent Masons, some of their findings revealed fraudulent programs. These programs have even doubled in the past year alone. Their conclusion further told that at least 3,500 scams came up before the Action Fraud. After that, these cases skyrocketed to at least seven thousand by the third month. This could have been worse. Especially when individuals spent their great time in their homes. And as a result, they started investing as they sought financial profits.

Safeguard your Future Investment today

The Action Fraud in the United Kingdom provided some helpful tips. All investors were to safeguard their investments.

First, investors shouldn’t make assumptions regarding several adverts popping up. There are many beautiful websites and social media platforms. These try to highlight such projects. It also came to our notice that scammers can use prominent personalities. They can even use brands to dupe individuals with their “legit” adverts.

In  addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.

addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.

addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.

addition, every investor should not rush into making decisions. This comes especially when fraudulent organizations tend to pressure people to make investments. Any genuine bank won’t display ‘greed’ programs and investments for swift rewards.People should also try to dodge spiced investment offerings. Especially investments made over cold communication. Thinking about undergoing an investment program? Simply acquire some professional advice after reviewing the financial entity first.

Finally, develop a cautious approach towards the crypto space. Of course, you may have come across some famous folks. They extol the values of the digital currency property investments to their disciples. Especially on social platforms. There are legit methods of carrying out investments on property via virtual currencies. It is vital to be aware of cite threats. These are mainly associated with property investments via digital coins. Avoid the ideology of untold wealthy folks programs which happen in a matter of few hours.

July 3, 2021

Comments Off on Zero-Knowledge Proof (ZKP) concept. What you Need to Know?

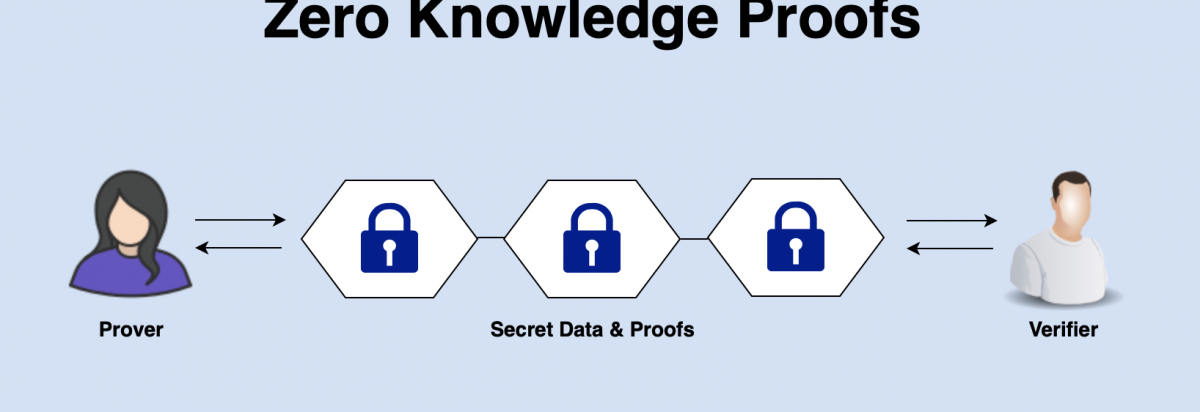

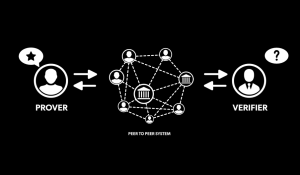

Ever come across a ZKP abbreviation? In short, it’s the Zero-Knowledge Proof. This is simply a protocol. It is useful for entities that want to safeguard their secret details. It is merely factual without necessarily letting the secret out of the bag.

ZKP Authentication and Application

This is a scenario that involves a prover and a verifier. The protocol may be into distinct aspects. That is, interactive or non-interactive. A good instance is when the ‘verifier’ takes to the ‘prover’ an H (hash).  In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.

In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.

In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.

In this case, the proving side proofs that the other party has secretive information. It has the capability to hash to H.The proving party produces a ZKP caring a prove that the verifying party has its data that can hash. In fact, no information revelation made to the verifying party. This will be regarding the information thereof.

Authentication Protocol

In the authenticity process, the proving agent makes proof. This drives the verifying agent towards the possession of a secret identity. Think of a case where the proving side has RSA or EC (Asymmetric Key Pairs). They can make use of the privatized key to issue a response. This will be a given problem sent as proof with the privatized key. In all cases, the privatized key is non-revealing. Although the verifying party might have proof of possession of the privatized. The ‘prover’ with all correctness executes several computations. Therefore, information transfer is not without making any revelation concerning the encapsulated secrets.

How Does the Blockchain Technology Relate with ZKP?

Back to the crypto world brief, we have a blockchain system. It incorporates a distinct listing of records. These  records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.

records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.

records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.

records are usually cumulatively managed by many entities globally. These entities possess lists with blockchain. This grants all involved entities in viewing entire transactions in the network. Therefore, there is no provision of private information or anonymity. The ZKP grants privacy, especially when dealing with transactions that require confidentiality. Therefore, offering a method to prove that transactions made with clarity. Thus, the party’s secret data is not revealed. Such data evolves around the amounts and addresses used in the entire transaction.Where is ZKP Applied?

The Zero Knowledge Proof applies in several aspects. Especially when dealing with information that needs encapsulation. One of the areas worth applying the ZKP framework is when preserving confidentiality. Data involved in the whole setup goes through encryption. Any proof posted for proves is then done with correctness. Another area where the ZKP application is to optimize the overall performance. This helps for apps supplied in the blockchain system. In this case, the app codes implementation is off-chain. It can also happen through a given computer. This might be available in the blockchain system.

July 2, 2021

Comments Off on American Senator Notices Main Disconnect After China Cracked down Bitcoin Miners

The United States senator who represents Wyoming posted interesting opinions. These were in regard to some developments linked to several Chinese miners. Miners involved recently moved from their location of investment. Cynthia Lummis termed the action by China as a severe mistake.

Prime Opportunity for Crypto Investment

To the United States of America, the mistake by the Chinese government is a prime opportunity. Especially if many individuals are aware and really understand more about digital assets.  She lamented the move stating the Chinese government isn’t careful. It will eventually end up making a stupid mistake. When it comes to working on financial innovations USA is much ahead of the rest of the world. She said these words offering an advisory statement to the United States. She also said to revisit the issue about digital currencies.

She lamented the move stating the Chinese government isn’t careful. It will eventually end up making a stupid mistake. When it comes to working on financial innovations USA is much ahead of the rest of the world. She said these words offering an advisory statement to the United States. She also said to revisit the issue about digital currencies.

She lamented the move stating the Chinese government isn’t careful. It will eventually end up making a stupid mistake. When it comes to working on financial innovations USA is much ahead of the rest of the world. She said these words offering an advisory statement to the United States. She also said to revisit the issue about digital currencies.

She lamented the move stating the Chinese government isn’t careful. It will eventually end up making a stupid mistake. When it comes to working on financial innovations USA is much ahead of the rest of the world. She said these words offering an advisory statement to the United States. She also said to revisit the issue about digital currencies.Their Mistake, Their Opportunity

To what is being termed as the biggest infrastructure re-location. Many see various industries, BTC miners closure in the Chinese republic. This started to take refuge in other nations to get a favorable environment. After a serious crackdown of BTC investment in China, clients have experienced pressure. This drove them to greener pastures for business launches. Most individuals have found their path to nearby investment points. While others are relocating to the States. Some are also moving to continental regions to quench their thirst for investments.

We also noticed something interesting about the regions these miners are selecting. These places mostly use up more energy expenses. It’s so because BTC miners normally spend energy-consuming procedures. Therefore, miners require to grab the competitive advantage by connecting less expensive power. According to reports, some states in America are capable to go through this process. So miners are more than ready to make moves in that direction.

The Unknown Crypto Climate in America

The advantage  for the US and other nations is opting to house miners from China. It can be huge especially if they grab the open door caused by the ‘mistake’. In fact, it’s a capital investment that’s very rewarding. The advantages for the electricity grids may comprise of cost-saving processes. This can also result in raised turnovers. Not to mention forgetting about the countless jobs it can create. Uncertainty is the possible rules and regulations. It may wake up from the legislature to regulate investments of cryptocurrencies.

for the US and other nations is opting to house miners from China. It can be huge especially if they grab the open door caused by the ‘mistake’. In fact, it’s a capital investment that’s very rewarding. The advantages for the electricity grids may comprise of cost-saving processes. This can also result in raised turnovers. Not to mention forgetting about the countless jobs it can create. Uncertainty is the possible rules and regulations. It may wake up from the legislature to regulate investments of cryptocurrencies.

for the US and other nations is opting to house miners from China. It can be huge especially if they grab the open door caused by the ‘mistake’. In fact, it’s a capital investment that’s very rewarding. The advantages for the electricity grids may comprise of cost-saving processes. This can also result in raised turnovers. Not to mention forgetting about the countless jobs it can create. Uncertainty is the possible rules and regulations. It may wake up from the legislature to regulate investments of cryptocurrencies.

for the US and other nations is opting to house miners from China. It can be huge especially if they grab the open door caused by the ‘mistake’. In fact, it’s a capital investment that’s very rewarding. The advantages for the electricity grids may comprise of cost-saving processes. This can also result in raised turnovers. Not to mention forgetting about the countless jobs it can create. Uncertainty is the possible rules and regulations. It may wake up from the legislature to regulate investments of cryptocurrencies.So far, the United State of America has shown great support in embracing this. Regions like Texas and Wyoming have shown great concern since then. It’s a thrilling opportunity for them to take advantage of this. These regions have a less expensive power supply. Although, their electricity grids are so delicate. Not looking at the fragile situations. Some crypto firms have moved to these places and established their rewarding investments. This means the United States can align itself to becoming the hot-spot for BTC mining.

June 24, 2021

Comments Off on Crypto Overturn: Bitcoin Haters and Crypto Cynics Are Not Right – Here’s why

We see significant sales this week after China cracked down on the crypto industry. However, the comments came from the Chief Executive Officer to Fintech companies. Companies detesting the digital move is not right in dismissing virtual assets. Nigel Green is the Chief Executive Officer and Chairman of the deVere entity. He also arrived at a crazed week when cryptocurrencies are just turbulent.

Now, there’s a rejection of at least 400 billion dollars in total. The is the cumulative virtual currency marketplace since last week on Friday. This happened when the central BTC mining spot gave an order to miners. The order terminated and initiated the closure of all mining activities.

Central Bank Meeting with Banks

Reports mentioned that the Central Bank to the Chinese republic held a meeting. Major banking institutions were present in the forum. It also issued several directives to deactivate payment hubs.  This also includes endorsers and backers of digital investments. The world’s most significant digital currency BTC faced trade sessions in the past 24 hours. It was also about to drop below the 30,000-dollar threshold. Many were following the sell-off by the digital currencies this week. The virtual coin advocate commented that for quite some long time now. Crypto traders with great zeal haven’t been the leading cause of this alarm.

This also includes endorsers and backers of digital investments. The world’s most significant digital currency BTC faced trade sessions in the past 24 hours. It was also about to drop below the 30,000-dollar threshold. Many were following the sell-off by the digital currencies this week. The virtual coin advocate commented that for quite some long time now. Crypto traders with great zeal haven’t been the leading cause of this alarm.

This also includes endorsers and backers of digital investments. The world’s most significant digital currency BTC faced trade sessions in the past 24 hours. It was also about to drop below the 30,000-dollar threshold. Many were following the sell-off by the digital currencies this week. The virtual coin advocate commented that for quite some long time now. Crypto traders with great zeal haven’t been the leading cause of this alarm.

This also includes endorsers and backers of digital investments. The world’s most significant digital currency BTC faced trade sessions in the past 24 hours. It was also about to drop below the 30,000-dollar threshold. Many were following the sell-off by the digital currencies this week. The virtual coin advocate commented that for quite some long time now. Crypto traders with great zeal haven’t been the leading cause of this alarm.Trades for Massive Wealth

To most traders who are more experienced, this may come out as a blessing. The lowered price catalyzed by panic sales will be a purchasing opportunity. Bitcoin is a cryptocurrency performing well in the Chinese republic. The BTC will locate methods to establish ways evolving around the system. This enhances their portfolios at lowered starting points. About this, people can anticipate an extra pullback concerning the price tags for BTC. Mr. Green, the crypto advocate, continued to say something similar. He said, “that it’s their expertise that traders aren’t in the digital business to generate swift bucks.” He added in the crypto business for the long term and future trading to create massive wealth.

Traders Drive to Digital Currencies

To begin with, we have the inflation factor that creates significant concerns. Especially when the economy  reopens, and the resultant demand will unveil. The whole industry is already met with distribution scarcity. The BTC is traditionally known as a factor that shields against inflation pangs. It is usually catalyzed by limitations in the distribution. It is not impacted by Bitcoin’s prices.

reopens, and the resultant demand will unveil. The whole industry is already met with distribution scarcity. The BTC is traditionally known as a factor that shields against inflation pangs. It is usually catalyzed by limitations in the distribution. It is not impacted by Bitcoin’s prices.

reopens, and the resultant demand will unveil. The whole industry is already met with distribution scarcity. The BTC is traditionally known as a factor that shields against inflation pangs. It is usually catalyzed by limitations in the distribution. It is not impacted by Bitcoin’s prices.

reopens, and the resultant demand will unveil. The whole industry is already met with distribution scarcity. The BTC is traditionally known as a factor that shields against inflation pangs. It is usually catalyzed by limitations in the distribution. It is not impacted by Bitcoin’s prices.The institutional backing skyrocketed trading from the leading institutional traders. These come with capitalization, specialization, and reputational strength. Lastly, the regulations which incorporate the money watchdogs come into play. They launched the regulatory aspect because of more synergy channeled to digital currencies. This was with zeal as a digital asset and a platform for exchange.

The Chief Executive Officer to deVere also concluded this statement. He said that “the digital currency haters are now celebrating hitting the virtual assets this week.” However, savvy traders are not spooking due to the present volatility aspect, he added. He also stated his confidence in the longer-term trajectories.

June 23, 2021

Comments Off on Canadian Elite Basketball Endorse BTC Salary Scheme

Just like other industries, the sports sector also agreed to embrace virtual currencies. Currently, numerous exceptional athletes are backing several virtual coins publicly. Others have gone ahead to establish private coins. In addition, there may be other firms that will follow in these footsteps. So now, the relations between the sporting and crypto industries are broadening.

A New Payroll Upgrade

The Canadian Elite Basketball League (CEBL) is one of them. It is the initial sports industry in Northern America adopting BTC to pay salaries. The firm has triggered this move after its latest partnership  with Bitbuy. It is a locally known crypto site. Now, it seems that the leading players will now start to receive a paid segment in the BTC format. Most individuals congratulated Canada, saying that the entire initiative is good news. However, others went ahead to say they would love similar treatments. They want employers to pay them 10 to 20 % of their salaries in cryptocurrency.

with Bitbuy. It is a locally known crypto site. Now, it seems that the leading players will now start to receive a paid segment in the BTC format. Most individuals congratulated Canada, saying that the entire initiative is good news. However, others went ahead to say they would love similar treatments. They want employers to pay them 10 to 20 % of their salaries in cryptocurrency.

with Bitbuy. It is a locally known crypto site. Now, it seems that the leading players will now start to receive a paid segment in the BTC format. Most individuals congratulated Canada, saying that the entire initiative is good news. However, others went ahead to say they would love similar treatments. They want employers to pay them 10 to 20 % of their salaries in cryptocurrency.

with Bitbuy. It is a locally known crypto site. Now, it seems that the leading players will now start to receive a paid segment in the BTC format. Most individuals congratulated Canada, saying that the entire initiative is good news. However, others went ahead to say they would love similar treatments. They want employers to pay them 10 to 20 % of their salaries in cryptocurrency.The Canadian Elite firm gave this official notice. It claimed that Bitbuy would be able to change a CAD salary to Bitcoin. The converted BTC will reach the club’s player’s wallets. The latest notice came after one of their players received it. Carolina Russel got half of the yearly pay in BTC. Russel’s cumulative annual salary is 13 million dollars. From this, 6.5 million dollars remitted as BTC. According to reputable sources, the player is the first to taste such payments in Bitcoin.

Expert Players Aware of the Great Opportunity in BTC

Of course, there is a newly introduced step and a much exciting opportunity. Kimbal Mackenzie came into the limelight to admit something similar. He believes that digital currency is the real future. It is also a well-weaved decision for the overall crypto development. Some salary part will go to investments in coming years.

Kimbal Mackenzie also recognized that the Canada Elite Basketball League. It is providing its team of players with modernized and forward thought open doors. The newly discovered opportunity comes with an exciting option. It gives players the chance to receive payments in BTC. Many people are getting excited about this.

What’s the Role of Bitcoin?

This  initiative gives BTC and altcoins a prominent position in international sports. This is an evolution and an improvement that seems to move at quite a swift pace. Adopting crypto-currency in the sports arena is an advancement for decades now. However, each pace matters, and the entire evolution is in the global environment.

initiative gives BTC and altcoins a prominent position in international sports. This is an evolution and an improvement that seems to move at quite a swift pace. Adopting crypto-currency in the sports arena is an advancement for decades now. However, each pace matters, and the entire evolution is in the global environment.

initiative gives BTC and altcoins a prominent position in international sports. This is an evolution and an improvement that seems to move at quite a swift pace. Adopting crypto-currency in the sports arena is an advancement for decades now. However, each pace matters, and the entire evolution is in the global environment.

initiative gives BTC and altcoins a prominent position in international sports. This is an evolution and an improvement that seems to move at quite a swift pace. Adopting crypto-currency in the sports arena is an advancement for decades now. However, each pace matters, and the entire evolution is in the global environment.Highlighting Takeaways:

· The Canadian Elite Basketball League announces its move to pay players using BTC.

· The initiative is representing the links between the crypto and sports industry.

· Bitbuy is responsible for processing the BTC payments for CEBL players.

June 20, 2021

Comments Off on What determines the price of a Bitcoin?

As you may have known, Bitcoin operates on a networking consensus. This further enables newly generated payments to complete the virtual money ecosystem.

Pretty Cash System for the Internet

Among all other digital currencies in the crypto space, Bitcoin is the firstborn of all. Hence,  becoming a more decentralized P2P transaction network, it has active clients worldwide. From the client’s angle of view, BTC is a prettier cash-like system for internet enthusiasts. Despite the critical founder going anonymous since 2010. The BTC community and forums have experienced growth. Users and countless developers have witnessed daily improvement in the BTC infrastructures. Nakamoto, the chief inventor of Bitcoin, left many with unjustifiable concerns. All these are mostly connected with the BTC framework as an open-source platform.

becoming a more decentralized P2P transaction network, it has active clients worldwide. From the client’s angle of view, BTC is a prettier cash-like system for internet enthusiasts. Despite the critical founder going anonymous since 2010. The BTC community and forums have experienced growth. Users and countless developers have witnessed daily improvement in the BTC infrastructures. Nakamoto, the chief inventor of Bitcoin, left many with unjustifiable concerns. All these are mostly connected with the BTC framework as an open-source platform.

becoming a more decentralized P2P transaction network, it has active clients worldwide. From the client’s angle of view, BTC is a prettier cash-like system for internet enthusiasts. Despite the critical founder going anonymous since 2010. The BTC community and forums have experienced growth. Users and countless developers have witnessed daily improvement in the BTC infrastructures. Nakamoto, the chief inventor of Bitcoin, left many with unjustifiable concerns. All these are mostly connected with the BTC framework as an open-source platform.

becoming a more decentralized P2P transaction network, it has active clients worldwide. From the client’s angle of view, BTC is a prettier cash-like system for internet enthusiasts. Despite the critical founder going anonymous since 2010. The BTC community and forums have experienced growth. Users and countless developers have witnessed daily improvement in the BTC infrastructures. Nakamoto, the chief inventor of Bitcoin, left many with unjustifiable concerns. All these are mostly connected with the BTC framework as an open-source platform.Who determines the price of a Bitcoin?

Supply and demand are critical for BTC pricing. Of course, when the demand rises, the price will eventually increase and vice-versa. Bitcoin has value since its usefulness qualifies them to become a “form of money.” Just like traditional money, the crypto Bitcoin has similar features. They are durable, portable, fungible, scarce, divisible as well as recognizable. These characteristics are usually based on the arithmetic property.

In the ecosystem, the cryptocurrency is usually generated at predictable and reducing rates. This implies that the demand curve is to go in the direction of inflation. After which, it will be able to achieve price stability. BTC remains small concerning the current market. Therefore, it does not utilize a substantial amount of money. This is to shift prices to either go upwards or downwards. For this reason, the Bitcoin currency becomes more volatile in its pricing aspect. The value for BTC remains only if individuals have the free will to embrace the money as a form of payment.

Who Manages Bitcoin?

We  have shed light upon factors determining the price of Bitcoin. Therefore, we can now look at the overall management of the BTC. In truth, no one has full ownership of the Bitcoin network. You can relate this to the technological practice behind emails. The BTC consumers are the ones who control the BTC network evolving around the globe. For compatibility issues, all consumers in the network can opt other alternatives. Therefore, compliance with the set rules becomes an essential requirement.

have shed light upon factors determining the price of Bitcoin. Therefore, we can now look at the overall management of the BTC. In truth, no one has full ownership of the Bitcoin network. You can relate this to the technological practice behind emails. The BTC consumers are the ones who control the BTC network evolving around the globe. For compatibility issues, all consumers in the network can opt other alternatives. Therefore, compliance with the set rules becomes an essential requirement.

have shed light upon factors determining the price of Bitcoin. Therefore, we can now look at the overall management of the BTC. In truth, no one has full ownership of the Bitcoin network. You can relate this to the technological practice behind emails. The BTC consumers are the ones who control the BTC network evolving around the globe. For compatibility issues, all consumers in the network can opt other alternatives. Therefore, compliance with the set rules becomes an essential requirement.

have shed light upon factors determining the price of Bitcoin. Therefore, we can now look at the overall management of the BTC. In truth, no one has full ownership of the Bitcoin network. You can relate this to the technological practice behind emails. The BTC consumers are the ones who control the BTC network evolving around the globe. For compatibility issues, all consumers in the network can opt other alternatives. Therefore, compliance with the set rules becomes an essential requirement.How would you get a fraction of Bitcoin or the whole of it? Bitcoin helps to complete transactions while you purchase anything. Clients can enroll at the Bitcoin exchange site to secure a part of it. Similarly, individuals can choose to exchange BTC with other enrolled applicants. In conclusion, people will find it simple to send and receive BTC. So, no matter the location, its nature of “Payment freedom” can benefit anywhere.