£0.00

March 20, 2019

Bitcoin Penguin Review

Bitcoin Penguin is the world’s leading bitcoin online casino in the world. As the name suggests, you can play the wide array of games that the platform offers using your bitcoins.

New players are automatically given a 100% bonus up to 0.2 BTC deposit and thirty free spins. You will also get a 75% bonus when you make the second deposit of up to 0.2 BTC.

Instant Cashouts and Deposits

Delays can discourage you from playing your favorite casino game. Bitcoin Penguin is committed to avoiding that by providing instant cashouts and deposits. This means that, all deposits and withdraws are processed instantly, you will never have to wait for hours for the bitcoins to reflect on your account.

Two Cryptocurrencies Supported

Unlike other online casinos that only allow players to deposit money using one digital currency, Bitcoin Penguin allows clients to enjoy the games by depositing either Litecoin or Bitcoin. The games are also provably fair and random, as the gaming software cannot be manipulated.

Anonymous Registration

The registration process is fast and anonymous. No ID check is done to verify your account and you can start playing the over 200 HD casino games immediately after registering.

Bitcoin Penguin is definitely one of the best bitcoin online casinos you should consider trying out today. As mentioned earlier, there are more than 200 games and you can pay using Bitcoin or Litecoin.

Support team is always available to answer any questions that you might be having. Register today to get the best online bitcoin gaming experience.

January 31, 2019

Connecting Online Sentiment Towards the Cryptocurrency Industry with Global Market Capitalisation

Recently, BlockchainDefender released a report examining the impact of online sentiment on the cryptocurrency industry, including how it affects the industry’s global market capitalisation. The report takes advantage of BlockchainDefender’s experience of analysing online sentiment.

Online Sentiment Affects Market Capitalisation

The first study in the BlockchainDefender report confirms that online sentiment towards cryptocurrency impacts the industry’s market capitalisation. The report illustrates this connection via a graph with different lines for search volume, sentiment and market capitalisation. The three lines all move together, both in terms of increases and decreases. This correlation is most obvious in the rises of late 2017 and the dip from January to March 2018. The last several months of the graph shows all figures stabilising.

Differences in Online Sentiment by Country

The report looks at the online sentiment regarding cryptocurrency in Japan, the USA, Germany and the UAE. Of these, the USA has the most negative sentiment and Japan has the least. The report indicates that most negative online sentiment comes from cryptocurrency industry news websites, social media platforms, blogs, forums, crypto review websites, and crypto company directories and websites.

Online Sentiment for Specific Cryptocurrencies

BlockchainDefender also examines individual cryptocurrencies in the report. Looking at Bitcoin in the same four countries, the most positive results are in the UAE, followed by Germany, the USA, then Japan. The most negative results are in the USA, followed by Germany, the UAE and Japan.

From a global perspective, Iconomi is the cryptocurrency with the most positive online sentiment. Bitcoin Cash sits at the other end of the spectrum with the most negative online sentiment.

The report ends with a look at online sentiment for a specific yet unnamed cryptocurrency that faced a hacking attack and subsequent crisis in 2018. Following the crisis, positive online content decreased while negative online content increased. Interestingly, these changes were more significant in the West than in the East.

Online Sentiment Towards Traditional and Cryptocurrency Exchanges

BlockchainDefender also evaluates online sentiment towards cryptocurrency exchanges with the sentiment towards traditional exchanges that are well-established. The team analysed data in four countries regarding ten of each exchange type. The analysis indicates that Google search results have much more negativity for cryptocurrency exchanges than traditional exchanges.

The report indicates that a key influence in this disparity is the lack of ownership of online sentiment for cryptocurrency exchanges. While traditional exchanges have ownership of 34.88% of their search results, crypto exchanges only own 17.75% of their results. That leads to a reduction in control, which translates to more online negativity.

The BlockchainDefender crypto industry report is available to view or download online.

November 27, 2018

Unlock Blockchain is a platform that is dedicated to providing accurate information about blockchain technologies. Here you will find intelligence reports as well as insights and trending news related to this new technology. The team also goes an extra mile to organize and provide details of upcoming roadshows and community building projects.

Carefully Researched and Written News Articles

In the current competitive digital world, websites need to have stellar content to attract a large audience. Unlock takes pride in having a committed team of researchers and writers who are conversant with cryptocurrencies and blockchain technology. Every day, this team uses its networks to source for trending news and feature them in articles that are later published on the website. Rest assured that you will find a new article whenever you visit the website.

Unlock Blockchain Forum

As mentioned earlier, this platform organizes event that are meant to empower the public about this new technology and its potent capabilities. Unlock Blockchain Forum is one of the events that it has organized and will be held in Dubai. The forum provides excellent opportunities for blockchain technology enthusiast to exchange ideas and knowledge. Companies will also get a chance to display their developments to the attendees.

Strategic Marketing

Unlock offers strategic marketing, communication, and public relation services specifically to blockchain companies that are interested in taking advantage of the unexploited market in the region. These services are rendered by a team of professionals who are skilled and conversant with the modern day marketing trends.

Finally, this platform offers advisory services such as roadshows to introduce new products and initial coin offerings (ICOs) to new clients and investors. Click here to learn more about Unlock today.

November 27, 2018

Amon Tech Review

Store, Exchange, and Spend Cryptocurrencies in One Wallet

Looking for an intelligent and multi-functional crypto wallet? Amon is an ideal choice for you. This intelligent wallet is connected to next generation crypto debit card that you can carry in your physical wallet without raising any attention.

Powered by AI (Artificial Intelligence)

One of the highlights of this wallet is that it is powered by a powerful AI (artificial intelligence) system that is wired to ensure that you enjoy spending your digital assets as well as traditional assets efficiently. At the moment, Amon wallet supports Ethereum, AMN token and Bitcoin. However, the developers have plans to include more cryptocurrencies and ERC-20 in the near future.

The cryptocurrency market is very volatile and knowing or predicting the performance of a particular cryptocurrency tomorrow is almost impossible. Thanks to AI system, Amon card users are given accurate information about the most performing cryptocurrencies that are supported by the wallet. This feature greatly helps users to efficiently spend their digital assets without having to spend hours online monitoring multiple cryptocurrency exchanges.

Easy Access and Use of Cryptocurrencies

One of the main objectives of Amon Tech team is to redefine the manner in which users utilize cryptocurrencies by provide accurate information about their values. The system is 100% secure so rest assured that your personal information will not be accessed by third parties without your consent or shared.

Finally Amon card provides one of the most convenient and ways of buying cryptocurrencies using either MasterCard or Visa. The newly purchased cryptos will be transferred directly to your Amon wallet for safekeeping. Get more insights about this ingenious cryptocurrency wallet here.

November 8, 2018

The Blockchain Summit Dubai is the last summit in the global blockchain summit series, and it will take place on November 27, 2018, at the Dubai Marina, Dubai, UAE. It is the leading blockchain summit in the Middle East, and it will bring together blockchain professionals and enthusiasts for a comprehensive program spanning ‘How-To’ case studies, debates from tech visionaries, and interactive roundtable discussions.

Network and Connect

It is a one-day summit that will have conferences and exhibitions and participants will get to connect with more than 350 business and industry decision makers, leaders, investors, and tech innovators. There will be no co-located side events and participants can expect unrivalled content, as well as life-changing networking events.

There will be cutting-edge case studies revealing how to integrate blockchain technology across various industries including, mining and exploration, insurance, utilities, logistics, media and entertainment and so much more. After the conferences, attendees will participate in roundtable discussions and hosted networking events where they will have a unique opportunity to connect with peers and explore topics that matter to their respective industries.

Visionary Speakers

The Blockchain Summit Dubai is in partnership with some of the leading brands in technology including PWC, SAP, IBM, CISCO, ORACLE, and Consensys, among others. The speakers in the summit will include Amna Al Owasis, Amol Bahuguna, Ramadan Alblooshi, Roula Zahar, Jameel Khan, Anshhul Srivastav, and more. All these are business leaders with diverse skills and competencies.

There will also be an interactive exhibition session from some of the leading tech companies as well as startups with innovative solutions to the current problems.

https://www.youtube.com/watch?v=a7Jyt1KB5PY

Register today and be part of the audience and learn from the visionary speakers who will grace the event.

November 8, 2018

The dust is settling on Blockchain Summit Singapore that was on 28th August 2018.

The event was at Suntec, Singapore and it was huge success. It had industry giants such as IBM, EY, KPMG, Deloitte, and Cisco sponsoring the event. The one-day event connected over 700 business and industry leaders, tech innovators, decision makers, as well as investors.

Future of Blockchain Technology

Blockchain Summit Singapore upheld the standards maintained by the global blockchain summit series by offering unique content and exceptional networking opportunities. Attendees were treated to over 60 speakers sourced from 15 industry sectors such as manufacturing and supply chain, energy and utilities, healthcare, insurance, music, transport, and charity, to name a few.

The speakers presented case studies and solutions on how to integrating blockchain technology in individual industry sectors. There were also over 700 qualified attendees, and it was the perfect opportunity to pick some of the brightest minds developing and interested in blockchain technology.

Blockchain Only Event

This was purely a blockchain event without any co-related events. In between conferences, attendees were treated to interactive exhibition sessions from 20 of the best tech innovators. This included industry giants who have continually provided solutions for decades as well as startups with innovative blockchain technology.

https://www.youtube.com/watch?v=LX7MeO_st5g

This was one of the last one-day blockchain summit sessions. As from 2019, the global blockchain summit series will span two days and offer more content and networking opportunities. In case you missed the 2018 edition of Blockchain Summit Singapore, register your email address and stay updated on when and where Blockchain Summit Singapore 2019 summit will be held.

October 18, 2018

There is no denying the impact of cryptocurrencies in the modern financial sector. However, the problems facing the industry such as security and lack of a proper regulatory framework has caused most governments to shun cryptocurrency in their jurisdictions. India is one of the countries that were fighting cryptocurrencies, but according to News BTC, India might be warming up to cryptocurrencies. The country is laying down the framework for a government-backed cryptocurrency.

India put together a board under the Finance Ministry in December 2017, and one of the sitting members in the board has confirmed the plans. At the time, the board was meant to recommend measures on how the government would direct cryptocurrencies. The board was mandated with investigating and it had to present its findings in July 2018. The official maintains that the board is in support of India developing its crypto coin. This is despite the fact that both the central bank and the government have tried to diminish the setup of cryptocurrency exchanges in the country.

Altcoins Remains Banned in India

However, it might be a while before we see India’s first cryptocurrency. A government official while commenting on the plans to create the cryptocurrency saying that it conflicted with the ideals that surround decentralized cryptocurrencies. In spite of this, the government still maintains its stand to ban cryptocurrencies even with their digital currency in circulation. Another official commenting on the issue said that anyone who would be found in possession of a different coin other than the government digital currency would be open to prosecution.

The reports of the government launching its altcoins came after the RBI intensified their efforts to prohibit the use of bitcoin in India. The agency issued an order to all local banks to cut lose all firms that incorporate cryptocurrencies into their business model, including all individual traders and cryptocurrency exchanges.

This order banning cryptocurrency entities from accessing banking services infuriated the stakeholders, and they have taken the central bank to court. However, the case is likely to drag on for a while, and there seems to be no imminent end to the tussle. Other players in the Indian cryptocurrency circles have tried to navigate the order, but they have not found a sustainable plan of doing business.

Lakshmi Token

Both the government and the RBI consider digital currencies too risky, with the fear of money laundering, fraud, and supporting criminal activity taking center stage. The only option left for cryptocurrencies to exist in India is if it is controlled, and this is where the plan of having a government-backed cryptocurrency comes in.

The RBI has proposed to name the government-backed cryptocurrency after Lakshmi, the Hindu goddess of wealth and riches. However, this is not the first government-backed altcoin. Venezuela is a notable case where they have the Petro, an altcoin backed by the nation’s oil reserves. The board convened to look into cryptocurrencies is expected to table its findings in towards the end of the year, and India might be a step closer to launching their Lakshmi token.

October 17, 2018

Cryptocurrency exchanges are making headway in improving the penetration of digital currencies, but few have the popularity that Bitcoin enjoys. According to CCN, YoBit is looking to use unconventional methods to drive up the number of traders on their platform. The plan is to randomly pump coins with the intent of driving up their prices. The exchange based in Russia said that it would inject 10 BTC which is equivalent to $66,000 into ten random markets.

In a tweet, YoBit plans to buy one random coin for 1BTC every 1-2 minutes, ten times. This is a drop in the ocean given that the global cryptocurrency market records $12 billion in daily trading volume. However, this will lead to a massive increase in prices of microcap altcoin markets that do not get much trading.

While many Twitter users thought that the YoBit account might have been hacked, the report seems to be true. Their website has a countdown timer to the self-described pump, which means that they are serious about pumping up coins.

Market Manipulation Ploy

Early on in the year, the US Securities Exchange Commission issued a customer advisory warning against such kind of pump-and-dump schemes and warned that they are illegal. While it remains to be seen if YoBit’s action is unlawful according to the SEC definition, the move is being heralded by many as a form of market manipulation.

According to the US Commodity Futures Trading Commission chairperson, J. Christopher Giancarlo, the CFTC is focused on combating fraudulent forces that seek to manipulate the cryptocurrency markets. In a Wall Street Journal report, CFTC has seen a significant increase in civil penalties in 2018. In the current fiscal year, CFTC has issued $900 million worth of penalties, which is larger than the amount levied in five out of eight years of the Obama administration combined.

CoinMarketCap currently ranks YoBit as the 51st largest cryptocurrency exchange in the world as per their adjusted daily trading volume. By the time of writing this article, YoBit had processed $19 million across 482 markets in the past 24 hours and more than $198 million over the past one month. The news come after a vast majority of cryptocurrencies closed the market on Wednesday at a loss. It is estimated that the market lost an estimated $13 billion with bitcoin leading the pack.

Pump and Dump Schemes

According to the Wall Street Journal, pump and dump schemes are on the rise and YoBit seems to be riding the wave too. The report by the WSJ claims that the operator of the scheme benefits the most and traders get anything from pump and dump schemes. It is thought that the allure of involvement keeps traders coming back. Big Pump Signal, a chat room with more than 74,000 followers on Telegram, initiated 26 pump operations that raised $222 million in December 2017.

YoBit announcement to randomly pump certain coins to increase their value borrows heavily from the pump and dump schemes model. A Business Insider investigation in November 2017 on pump and dump schemes revealed that there were traders conducting pump and dump schemes on YoBit via Telegram. It is not clear whether the YoBit team is aware of the activity on their platform, but their latest news does not help their cause.

October 16, 2018

Traditional financial institutions do not see eye to eye with cryptocurrency firms, but this is about to change. According to Ethereum World News, the Monetary Authority of Singapore is looking to bridge the gap by helping cryptocurrency firms set up accounts in local banks. The financial watchdog cited that digital currency firms are finding it hard to open bank accounts the world over, and this will only impair the growth of the financial services sector. Despite this, the agency vowed that it would not slacken its rules to favor and entice cryptocurrency firms.

Crypto fintech firms in the Asian country have let their complaints known, and they continue to push the government to set up a regulatory framework that will allow them to open regular bank accounts. On the issue, Ravi Menon, the Monetary Authority of Singapore Managing Director, said that they are not trying to create lax regulations to attract the crypto business, but the aim is to bring cryptocurrency fintech startups and banks together to reach a common understanding.

Cryptocurrency Firms and Banks Collaboration

Ravi adds that due to the obscure nature of cryptocurrencies, banks must establish robust methods of authentication. The fintech startups must also chip in to ensure a strong collaboration in good faith. Ravi adds that the Singaporean banks need to apply caution due to the obscurity associated with cryptocurrency business model.

The main agenda of the Monetary Authority of Singapore is to protect investors from fraud, and curbing money laundering especially when it comes to the cryptocurrency sector. The move to ease the tension between cryptocurrency fintech startups and banks is geared toward creating more jobs and spurring innovation. The country had placed stringent measures that sought to harbor the operations of cryptocurrency firms.

Leading Cryptocurrency Adoption in South East Asia

Other than the lack of regulation, Singapore is the third largest ICO launch pad after US and Switzerland. For example, Line Corporation, which is Japan’s biggest instant messaging platform, launched its cryptocurrency exchange platform, Bitbox, in Singapore in July 2018. Binance, one of the largest cryptocurrency exchanges in the world, also set up its camp in Singapore and promised a fiat-cryptocurrency exchange that would be operational by September 2018.

Singapore is looking to go the Japan way and allow as many cryptocurrency trading and exchange platforms to operate in the country as long as they stick to the rules. Their approach to cryptocurrency regulation is more relaxed than in Japan, and this makes the country a testing ground for new technologies. Crypto.com, a blockchain fintech startup with headquarters in Hong Kong, is looking to issue the first Asian cryptocurrency Visa debit card, and it is starting the rollout in Singapore.

Different Approach to Regulation

Japan remains the ideal model for countries looking to regulate cryptocurrency firms, but Singapore in a bid to pave the way for cryptocurrency adoption is looking to a different supervisory model. They have three categories, utility tokens that pay for computing services and will hardly require any regulation. Digital tokens will be governed by the Securities and Futures Act and payment tokens which the Ravi and the Monetary Authority of Singapore do not have a problem with unless they are securities. Surprisingly, the country expressed interest in becoming the first country that will fully integrate DLTs and virtual currency.

October 2, 2018

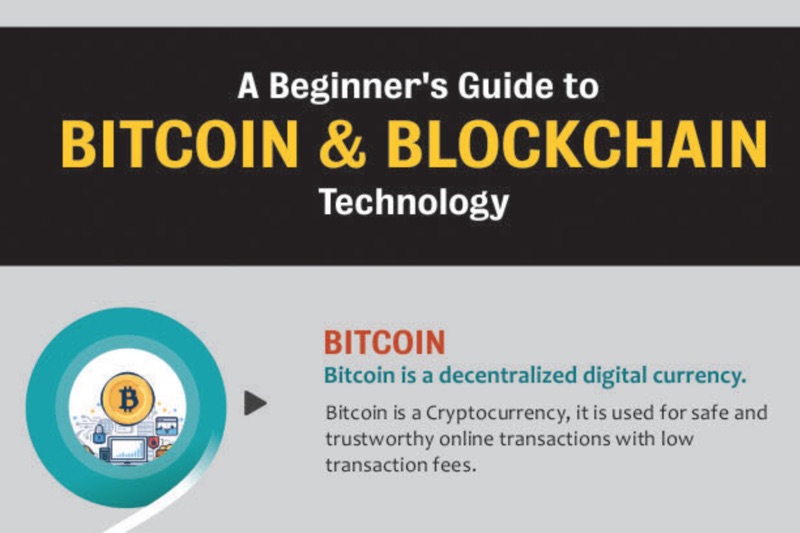

As bitcoins continues to create buzz across the world, let learn the basics of bitcoin.

Bitcoin is essentially a digital currency that unlike any fiat money is not owned by countries or central authorities. It is governed by the huge community if bitcoin users and is free from any corporate monopoly too. Its secure digital nature makes it easy to transfer all over the world that too at a very low expense. More and more individuals and businesses are adopting and accepting bitcoin as transactions are secure, faster and anonymous.

A bitcoin user uses a digital wallet to store, spend and receive bitcoin. While installing a bitcoin wallet a private key also known as ‘seed’ is set up. It ensures the safety and security of a transaction while the wallet is used.

Bitcoin works on the blockchain technology that is basically a shared public ledger on which the entire Bitcoin network relies. Any confirmed transactions (including newly added bitcoins) are added into blockchains. The ledger is maintained by the public & anyone can use the ledger to match a transaction.

Bitcoin mining involves complex mathematical calculations for the Bitcoin network users, to confirm transactions and increase security. Those who use their computers and resources for bitcoin mining are called miners.

When you make a Bitcoin transaction, your Bitcoin software uses your private key to signs the transaction cryptographically. Unlike normal transactions, here you don’t give our personal details. Only the wallet address is visible and this ensures anonymity & safety.

Bitcoin was made available to the public in 2009 by an anonymous Satoshi Nakamoto whose goal was to create “a new electronic cash system” that was “completely decentralized with no central power or authority.” In the year 2010, a person sold 10,000 Bitcoins for the first time to purchase two pizzas. Now, Bitcoin is widely accepted all over the world in different fields, and its future is beyond the imagination.

Our friends at Bitcoinfy.net developed an interesting infographic on Bitcoin & Blockchain Technology, please have a look at it, and share your thoughts.